When opening a bank or building society account, you are putting your trust in that firm. You trust that it will look after your money and that it will be there when you want access to it. Also, if you buy a policy with an insurer, you would expect it to pay out when you need it.

Banks, as well as other financial services (eg insurers and building societies) are all businesses. Their success is measured in the same way as others, including by the profit they make. But they also hold your money so that you can make payments and manage your finances – and there is a responsibility that comes with this.

That is where the PRA comes in. As part of the Bank of England, it makes sure firms do business safely and reduce their chances of getting into financial difficulty.

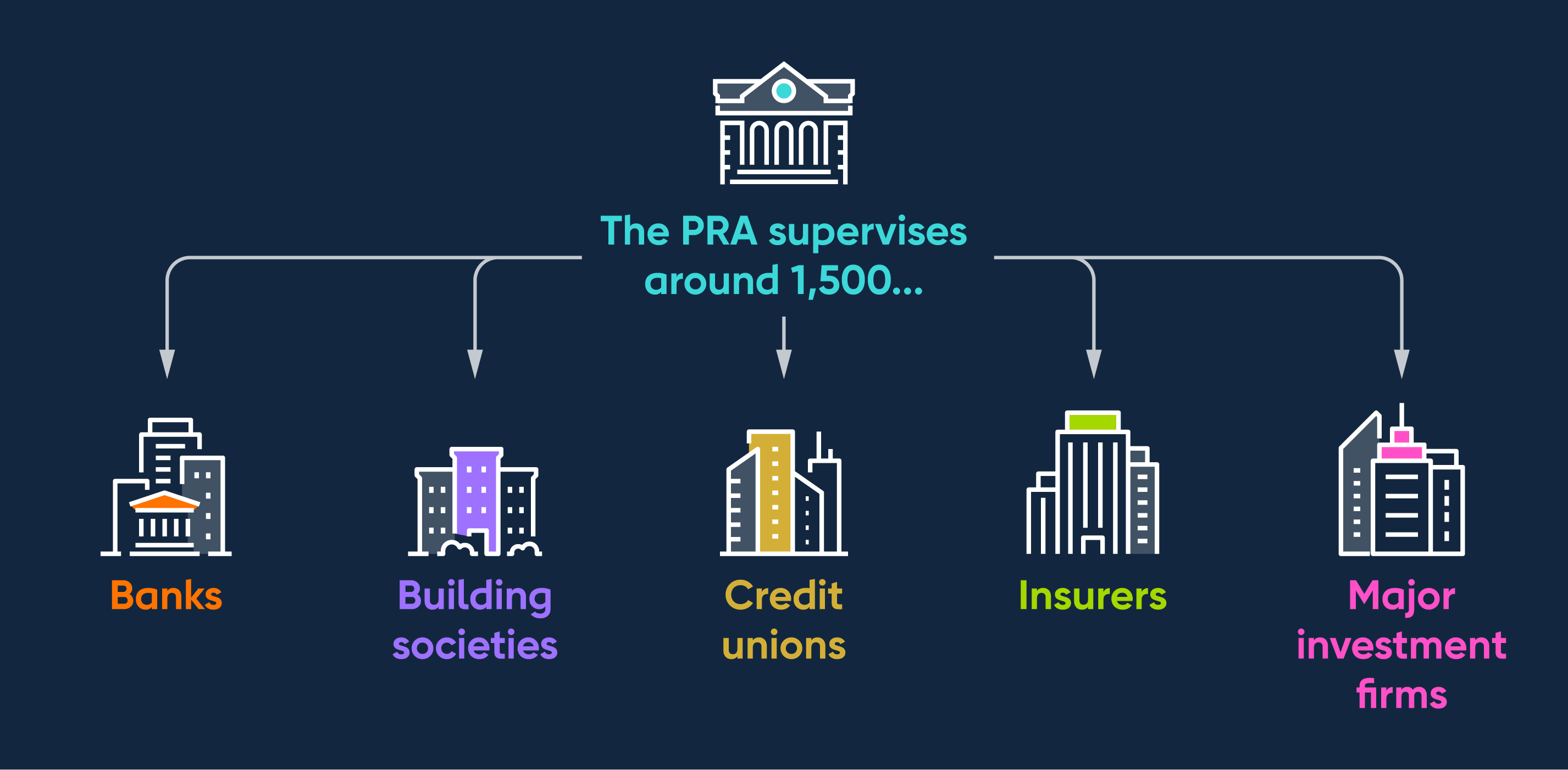

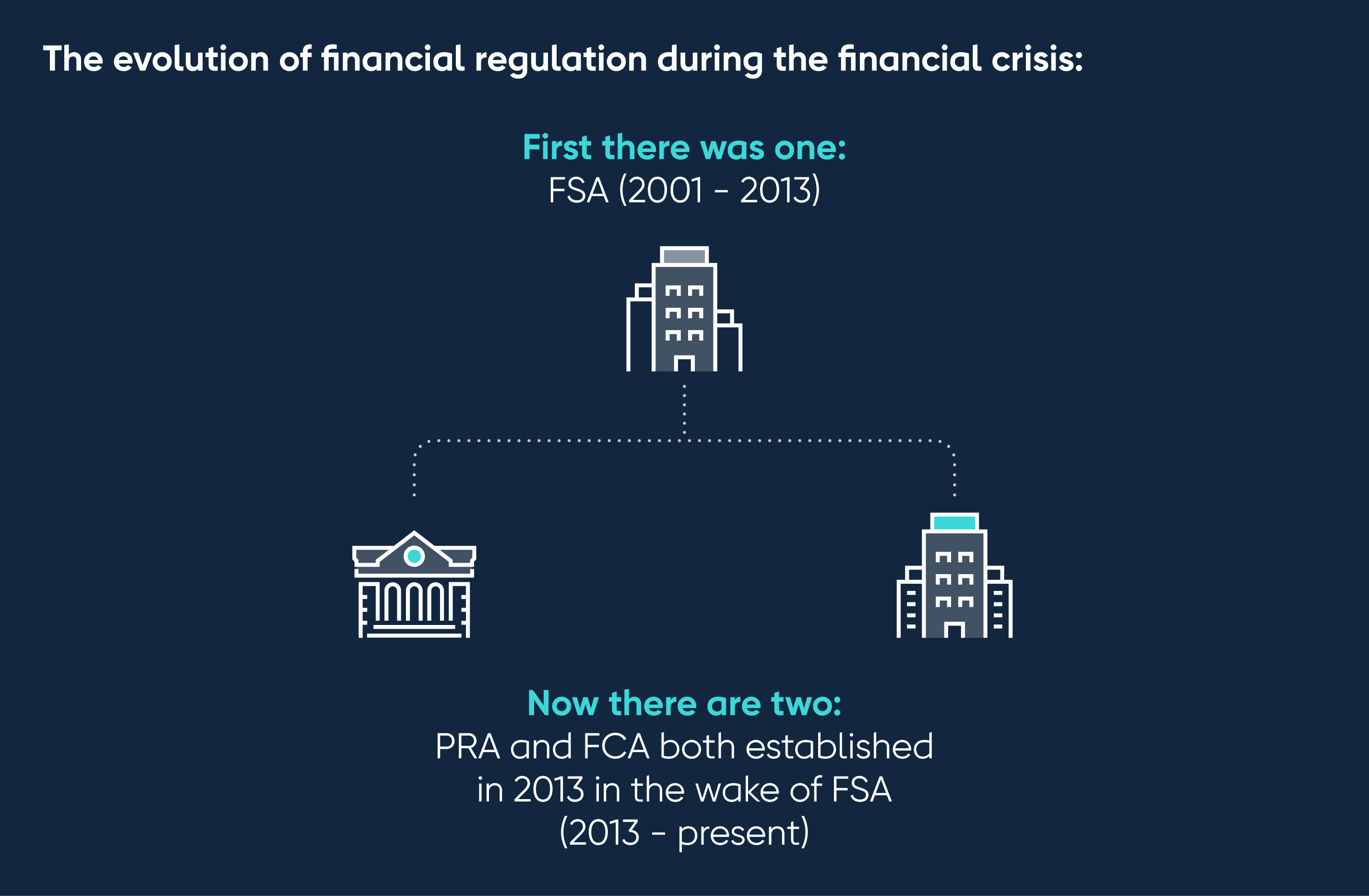

The PRA was established as part of a new wave of regulation after the financial crisis of 2008. Today, it supervises about 1,300 financial institutions.

What does it do?

It creates policies for firms to follow and watches over aspects of their business – this is called supervision. The aim is to ensure that the financial services and products that we all rely on are provided in a way that does not put customers, their money or the economy at risk.

Also, the PRA makes sure the right systems are in place so that banks/insurers can deliver what they have offered their customers. It does this through:

- Tailored supervision: Each firm is supervised according to its needs and the impact it would have on the economy should it go bust. One size does not fit all, so this makes it easier to spot when things are going wrong.

- A forward-looking approach: Things might be going well today, but what about in an unexpected event? The PRA tests stressful scenarios on firms to see how they would respond. From there, it works with them to develop strategies to build resilience in crisis situations. It also encourages them to keep enough money aside in case of any economic shocks that lead to financial losses.

- Big-picture thinking: Not surprisingly, if banks stopped working, the entire economy would grind to a halt. Similarly, if an insurer was unable to pay out, this could affect several people and businesses. The PRA's aim is to ensure that the entire financial system works safely and soundly. If things do go wrong, it tries to ensure this happens in an orderly way, ie without causing damage to the wider economy.

Who are the UK regulators?

We already know what the PRA does – but how does that compare to the FCA? The PRA and the FCA are separate entities, although they do work closely on certain issues/firms.

While the PRA's job is to make sure firms are stable and resilient, the FCA works with them to make sure they treat customers fairly. One of its responsibilities is ensuring fair practice in consumer credit.

This means regulating how loans, mortgages, credit cards and other financial products are offered – making sure the way they conduct their business is transparent and honest. For example, the FCA would step in if a firm was engaging in

scams or misleading consumers.

Also, if you want to check if a firm is legitimate or report a possible scam, the FCA is the go-to contact.

Inside the Bank of England

PRA and Financial Policy Committee (FPC)

The PRA and the Financial Policy Committee are part of the Bank of England. They both work to keep the financial system safe and stable but focus on different things.

The PRA deals with individual firms, while the FPC is responsible for financial stability across the entire economy.

For example, one of the PRA's jobs is to make sure firms have enough money set aside in case of sudden financial losses or shocks. Meanwhile, the FPC watches out for major risks that could affect the whole system, eg if people or businesses are borrowing more money than they can realistically pay back – which could lead to economic instability and even trigger a recession. The FPC can also give instructions to the PRA to help manage such risks.