If you are borrowing money, the interest rate (or lending rate) is the amount you are charged for doing so – shown as a percentage of the total amount of the loan. The higher the percentage, the more you must pay back.

If you are a saver, the interest rate (or savings rate) tells you how much money will be paid into your account, as a percentage of your savings. The higher the savings rate, the more you will get.

Even a small change in interest rates can have a big impact. So, it is important to keep an eye on whether they rise, fall or stay the same.

What is Bank Rate?

It is the core interest rate in the UK and it is our job to set it.

It is the rate of interest we pay to commercial banks, building societies and financial institutions that hold money with us. It is also the rate we charge on loans we may make to them. It, therefore, influences their own lending and savings rates. For example, when we raise the Bank Rate, banks will usually increase how much they charge their customers on loans and the interest they offer on savings. And the reverse if we lower it.

At the moment, Bank Rate is 3.75%. We will announce our next decision on Thursday 19 March 2026. You can see our full list of upcoming dates along with links to more detailed reports.

How Bank Rate has changed over time

Why are there so many different interest rates?

The number of different rates available when you borrow or save can be confusing.

The interest rates high street banks set depend on more than just the Bank Rate.

For loans, other factors are considered, including the risk of the loan not being paid back.

The greater the lender thinks that risk is, the higher the rate it will charge. It can also depend on for how long you want to take out a loan or mortgage.

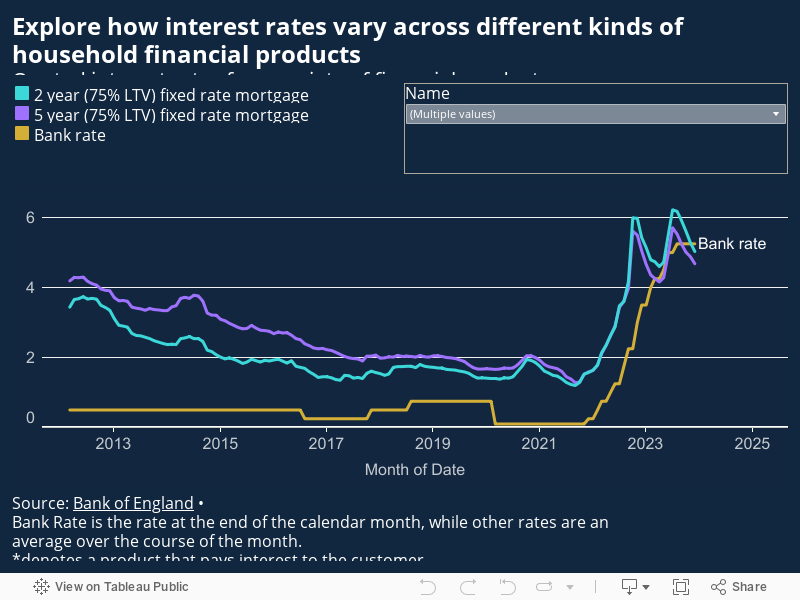

You can use our interactive chart to see how interest rates of different financial products have changed over time. Choose a product from the drop-down menu.

Why do interest rates matter for me?

Bank of England's explainer on why interest rates matter.

-

Hi, my name is Geoff and I work at the Bank of England. Today I’m going to tell you about interest rates. Interest rates were cut sharply in 2009 and remain extremely low by historical standards. With rates so low for so long do they really matter anymore? Yes they do.

Whether you’re running a business or a family on a budget, interest rates continue to affect our daily lives and have a big impact on what’s left over to spend on essentials each month. For most, interest payments on a mortgage are one of the biggest outgoings. Covering the cost of spending on credit cards and pay day loans can also be a big drain. Many of those with savings rely on interest payments from the bank to provide essential income to live on. So whether you’re a saver or a borrower, the level of interest rates for you and your family, really does matter.

If interest rates rise, borrowing could become more expensive for you. Whether you are looking to get a mortgage to buy a house, or a new car on credit, it is crucial to think about what higher costs mean for you.

Imagine you have a £130,000 mortgage that you want to pay off over 25 years. If the interest rate on it is 2.5%, the monthly repayment will be £583.

But if the interest rate is 3.5%, the monthly repayment will be £651.

Of course, interest rates can go down as well as up. If the mortgage interest rate was 1.5%, the monthly repayment would be about £520.

It is key to understand how a change in interest rates could affect your ability to pay. You can use a mortgage calculator to work out how your monthly payments could change.

How do higher interest rates bring inflation down?

Interest rates influence how much people spend, and that changes how shops and other businesses set their prices.

Higher interest rates mean higher payments on many mortgages and loans, meaning people must spend more on them and less on other things.

It also means savers get more return and potential borrowers find it is more expensive to take out a loan. These things make it less attractive for consumers and businesses to spend money.

When customers spend less, businesses are less willing or able to raise their prices. When prices don’t go up so quickly, inflation falls.