5 June 2024

King Charles III notes enter circulation

The first Bank of England banknotes featuring King Charles III’s portrait were issued on this day. This marked the first time we have changed the monarch on our banknotes. The first monarch to feature on our banknotes was Her late Majesty, Queen Elizabeth II, in 1960. Other than the King’s portrait, the designs on all four denominations of the notes (£5 ,£10, £20, £50) remained unchanged from the Queen Elizabeth II polymer notes.

King Charles III banknotes

13 September 2016

First polymer banknote released

The first Bank of England banknote printed on polymer – the £5 note featuring Sir Winston Churchill – was issued on this day. Polymer is a thin, flexible plastic material that lasts longer, stays cleaner and is harder to counterfeit than paper banknotes.

2012

Prudential Regulation Authority (PRA) formed and Financial Policy Committee (FPC) formed

Following the financial crisis of 2007-08, the Government decided to bring in massive regulatory reform. Reforms to the financial system came through the Financial Services Act (2012) which announced:

- an independent Financial Policy Committee (FPC) created at the Bank of England

- a new prudential regulator, the Prudential Regulation Authority, created as a subsidiary of the Bank

- new Bank of England responsibilities for supervising financial market infrastructure providers.

Street view of Moorgate building

1997

Bank of England agencies open

The Bank of England used to have branches around the country. But in 1997 they were replaced with 12 regional agencies. The former Leeds branch became a cash centre to help distribute banknotes around the country.

The Agencies are the Bank of England’s ‘eyes, ears and voice’ in their regions. They collect information about trends and new developments and help to explain our policy decisions to businesses, industry and labour groups.

Find out more about the Bank of England Agents.

Glasgow Office, May 1979 which later became the Agency for Scotland in 1997 (Archive reference: 15A13/12/16/13)

1996

Real-time gross settlement begins

The Bank of England has provided a way for two or more institutions to settle payments without settlement risk since the mid-19th century.

In 1996, our real-time gross settlement (RTGS) system was set up to allow institutions, predominantly banks, to settle payments in a variety of ways. Most payment systems in the UK use the Bank’s RTGS system to settle payments between their member banks and other institutions.

On an average day, the RTGS system settles around £775 billion between banks and other institutions.

October 1996

Launch of the Financial Stability Review (FSR)

In the autumn of 1996, the Bank of England launched a new publication, the biannual Financial Stability Report (FSR). Since then, the FSR has highlighted developments affecting the stability of the financial system, and promoted our latest thinking on risk, regulation and market institutions.

The first edition discussed CREST payments, electronic money and a review of the London Metal Exchange.

In 2006, to reflect a change in content and aims, the name was changed to the Financial Stability Report.

1996 Financial Stability Review publication cover

1994

The Bank of England turns 300!

In July 1994, the Bank of England celebrated its tercentenary (300th birthday).

To mark the occasion, 130 central bank governors were invited to attend a symposium on the future of central banking. The symposium ended with a panel session involving Lord Richardson, Paul Volcker, Jacques de Larosière and Karl Otto Pöhl. It was accompanied by events including a musical gala at the Barbican Centre and a commemorative £2 coin by the Royal Mint.

The celebrations culminated in a service of thanksgiving at St Paul’s Cathedral, attended by HM Queen Elizabeth II, the Prime Minister, members of the Cabinet, past governors and directors, the Lord Mayor and Mayoress of London, and other representatives from Westminster, Whitehall and the clergy.

Front and back £2 coin

February 1993

First Inflation Report published

In October 1992, the Chancellor invited the Bank of England ‘to provide a regular report on the progress being made towards the Government’s inflation objective’. Accepting the invitation, the then Governor Robert Leigh-Pemberton said the Bank’s aim would be ‘to produce a wholly objective and comprehensive analysis of inflationary trends and pressures’.

The first quarterly Inflation Report was published in February 1993. It is now called the Monetary Policy Report and to this day it is still one of our major publications. Published quarterly, it is followed by a press conference, held by the Governor and the Deputy Governor for Monetary Policy.

1993 inflation report publication cover

16 September 1992

UK crashes out of the European Exchange Rate Mechanism

The European Exchange Rate Mechanism (ERM) was set up in 1979 to reduce exchange rate variability and achieve monetary stability across Europe. This was seen as preparation for monetary union, which eventually led to the European single currency (the euro). All currencies had to remain within two agreed price points.

The UK joined the ERM in 1990. However, following massive rises in interest rates and intervention in the foreign exchange markets that failed to move sterling from the floor of the ERM, the Government made the decision to pull out, as the cost to try and keep it within the boundaries was deemed too expensive.

The ensuing financial crash was referred to as ‘Black Wednesday’. It was estimated to have cost HM Treasury over £3 billion.

The next day’s interest rate rise to 15% was cancelled, and regular meetings between the Chancellor and the Governor were set up to help the Chancellor with monetary policy.

9 September 1970

The Bank of England issues its first pictorial note

The £20 note issued in 1970 featured William Shakespeare on the back, along with the famous balcony scene from Romeo and Juliet. It marked the beginning of a brand-new series of banknotes (Series D) featuring a historical figure on the back.

Portraits and highly detailed machine engraving were blended into historical scenes, making the notes more difficult to copy.

The Shakespeare £20 note was the work of Harry Norman Eccleston MBE, the Bank’s first full time artist-designer, and his assistant Roger Withington.

Front and back design of first pictorial £20 note

1968

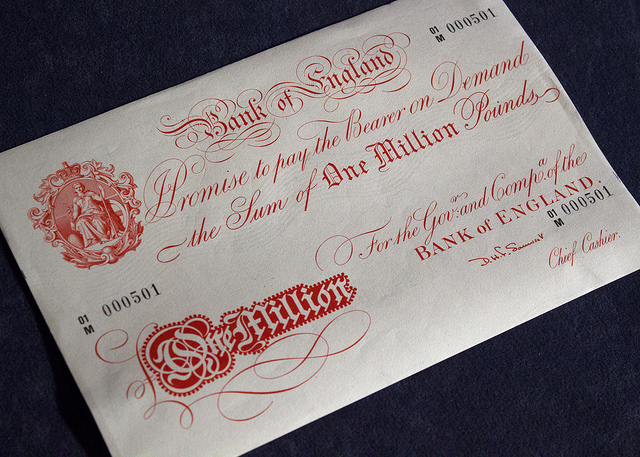

First 'Giants' printed

In 1968, we printed our first ‘Giant’ banknotes. With a face value of £1 million, they are printed in a different style from our other notes, and will never leave the Bank of England building. Similar to Titans (worth £100 million), they play an important role in backing the value of Scottish and Northern Ireland banknotes.

One million pound banknote

1960

First Quarterly Bulletin published

We published the first edition of our Quarterly Bulletin in late 1960.

The first Quarterly Bulletin contained Governor Cameron Cobbold’s Mansion House speech, an article on the procedure of special deposits at the Bank, an article on the financial surplus of the private sector, and the monetary statistics of the day.

Portrait of John Standish Fforde

1960

HM Queen Elizabeth II becomes the first monarch to appear on Bank of England banknotes

On 17 March 1960, we issued our first banknote featuring HM Queen Elizabeth II. Up until this point, Britannia had been the only character to appear on our banknotes.

We have since used a number of images of HM Queen Elizabeth II on our banknotes, and the portraits have come to be an important anti-counterfeiting feature. This is because people are more likely to notice slight differences in facial features than they are differences in images of inanimate objects.

Front and back design of 1970 £1 note featuring HM Queen Elizabeth II

1946

The Bank of England is nationalised

Throughout our history, we have always seen ourselves as a public institution, acting in the national interest. Although the Bank was privately owned for a long time, our activities were determined by the Government and legislation.

When the Bank was nationalised in 1946, it meant that it was now owned by the Government rather than by private stockholders.

This gave the Government the power to appoint the Bank’s governors and directors, and to issue directions to the Bank. To date, the Government’s power to issue directions has not been used.

1940s

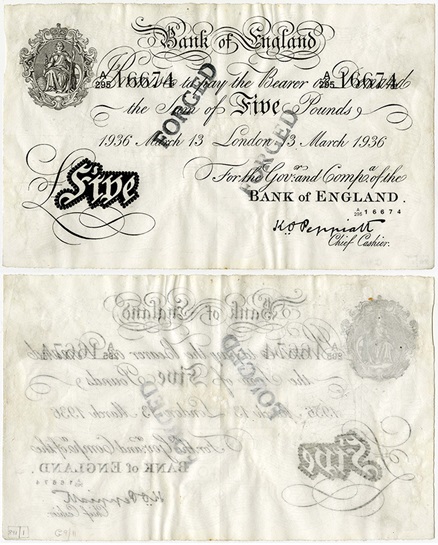

Wartime banknote forgeries

In an attempt to destabilise the British currency during the war, the Nazis introduced forged £5 notes into Britain. These forged notes were printed in the Sachsenhausen concentration camp outside Berlin. The project was codenamed ‘Operation Bernhard’.

At this point in time, the design of our high-value banknotes (from £5 up to £1,000) had not changed for almost a century. The way they were produced had also continued unimproved, with the result that they were copied extremely successfully by the Germans.

Almost 9 million notes with a face value of £134 million were printed by the Nazis – a figure that represented more than 10% of the total banknotes then in circulation in the UK. At the time a Bank of England banknotes expert described them as ‘the most dangerous ever seen’.

Emergency measures were taken to slow this down, including the 1940 special blue £1 note, which is the first time we used a metallic thread in a banknote. In 1943, we temporarily stopped issuing denominations greater than £5 to tackle the threat of counterfeiting.

Front and back counterfeit banknote

1939-1945

World War II at Threadneedle Street

During the Second World War, some of the Bank of England’s operations were evacuated to Hampshire. However, the gold remained in London.

During the Blitz, the Bank was luckily never hit by a bomb. However, there was some minor damage to the outside of the buildings as the road outside near the Royal Exchange suffered a direct hit.

Group of Women in fire guards uniform

1931

Gold standard suspended

The gold standard linked the value of the UK currency directly to gold, and effectively enabled people to exchange Bank of England banknotes for the equivalent value of gold.

In September 1931, the UK suspended the gold standard. Confidence in sterling had collapsed, and the ensuing run on sterling meant that the Bank of England lost much of its reserves.

Rows of gold stacked up on shelves in the vaults

1925

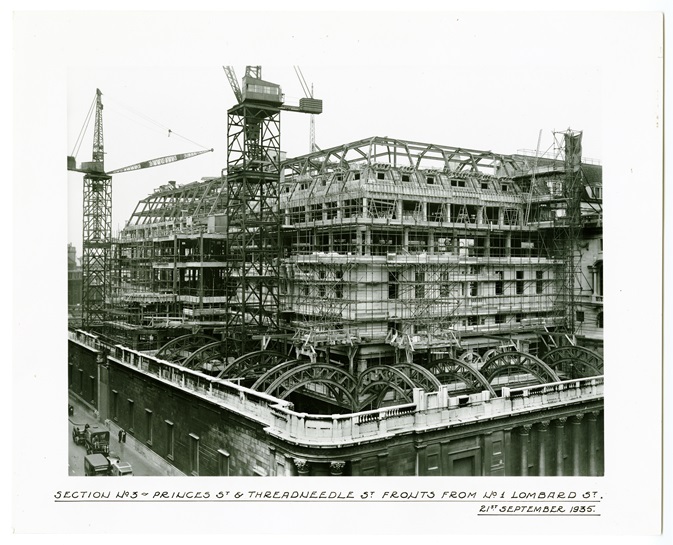

Threadneedle Street rebuilt

Between 1925 and 1939, Bank of England architect Sir Herbert Baker demolished what had become known as 'the old Bank' or 'Soane's Bank'. The old Bank, designed by architect Sir John Soane, was regarded as one of London's architectural gems. Sir Herbert built a new headquarters for the Bank of England on the same 3.5-acre Threadneedle Street site.

The old Bank of England had mostly been no more than three storeys high. The new building stood seven storeys above ground, and dropped three below to fit in the extra staff needed to tackle the Bank's rapidly increasing amount of work and responsibility.

Street view of construction work on the Bank of England in 1935

1920

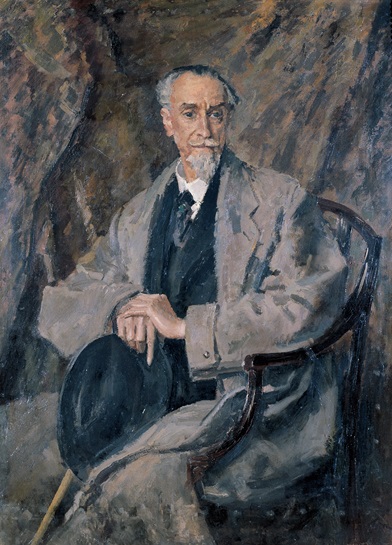

Montagu Norman becomes Governor of the Bank of England

Montagu Norman was Governor from 1920 to 1944. To this day, he is the longest-serving Governor of the Bank of England.

Norman played a critical role in rebuilding the international monetary system after World War One. He was involved in creating the Bank for International Settlements and the League of Nations.

Under Norman, the Bank of England became actively involved in supporting British industry. During the Second World War, he made significant contributions to monetary and financial policy.

Montagu Norman portrait painting

1914-1918

World War One

On 10 August 1914, the Court of Directors minutes announced that the Governor ‘had granted leave with full pay to as many clerks as could possibly be spared to serve in the Defensive Forces of the Country.’

Seventy-one Bank of England staff lost their lives during World War One. Today, we honour those members of staff, along with those who died during World War Two, in the Bank’s entrance hall and with a statue in the garden court that was commissioned after the war.

The Bank of England played an important role in helping the Government finance the war, for example by issuing War Stocks in 1914. Although it was reported that these war stocks were oversubscribed, the public did not actually buy enough to help fund the effort. The Bank therefore bought much of the stock out of its own reserves, and hid this fact to maintain public confidence. This was recently discovered in analysis of the Bank’s ledgers by our researchers.

Statue of St. Christopher and the Holy Child on his shoulder

1908

The Bank of England Sports Centre opens in Roehampton

In 1908 – the same year as the London Olympics – the Bank of England opened a sports centre for its staff in Roehampton. This was next to the Bank’s records centre, and was founded to encourage cooperation and understanding between staff at all ages and levels of seniority. Office accommodation was also included, including the Record Office.

The clubhouse was destroyed by an incendiary bomb in November 1940, and a new pavilion was built between 1955 and 1956. In December 1995, the club opened to local people to meet the growing costs of the centre.

1894

First woman officially employed by the Bank of England

In 1894, Miss Janet Hogarth became the first woman officially recorded as working for the Bank. Janet was appointed as the first Superintendent of Women Clerks, at a wage of £157.10.0 – a good salary at the time. Six years earlier, she had received a First from Oxford University.

Janet then employed Miss Elsee, a Cambridge history graduate, as her assistant on a wage of £105 a year. These two were soon supervising a group of women who were employed in sorting and listing banknotes. You can see a record of their appointment on pages 79 to 82 of the Court of Directors minutes from 1894.

Janet Hogarth framed portrait

1870

Signing of banknotes by Chief Cashiers

There has been a Chief Cashier at the Bank of England since it was founded in 1694, and the jobholder has always been paramount in the issuance of our banknotes.

In 1870, the Chief Cashier (at the time George Forbes) became the only person to sign Bank of England banknotes. This tradition has continued, and all banknotes printed and issued by the Bank of England bear the signature of the current Chief Cashier.

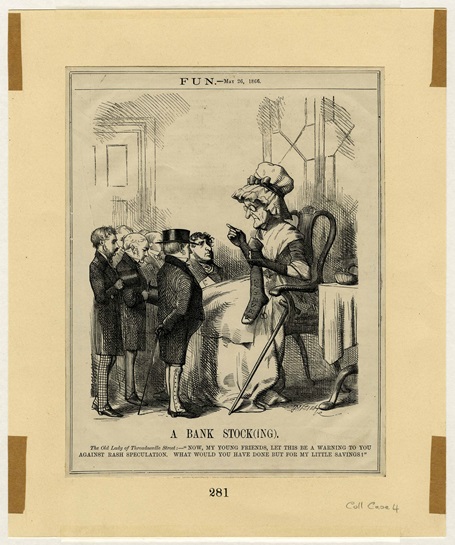

9-10 May 1866

The Overend Gurney financial crisis

There have been many financial crises over the course of the Bank of England’s history. One of the most well-known in the UK is the Overend Gurney crisis of 1866.

Overend Gurney was the largest discount house of the time. Despite being a profitable business, over time it built up large piles of bad loans. When it tried to extend the credit lines on these loans, Overend Gurney suffered significant losses. This ultimately led to its demise, and it suspended payments on 10 May 1866.

On 9 May 1866, the Bank of England had been approached for assistance by Overend Gurney. The Bank refused on the basis of the broker’s insolvency.

The failure of Overend Gurney and the subsequent events led to heated policy debate that helped shape the Bank of England as a lender of last resort for years to come.

Quarterly Bulletin article: the demise of Overend Gurney

Cartoon of The Old Lady of Threadneedle Street

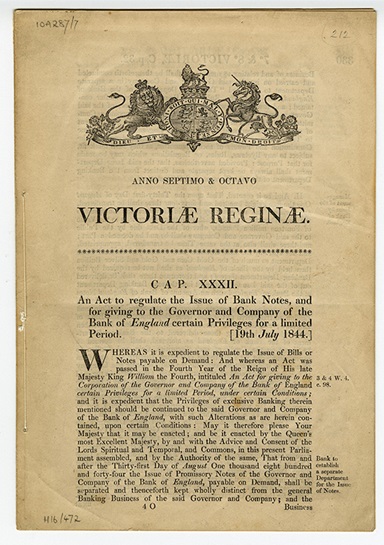

1844

Bank Charter Act

The Bank Charter Act of 1844 gave the Bank of England a range of new powers and formalised the issuance of banknotes in the UK. This Act of Parliament placed restrictions on any banks, companies or persons in England and Wales that issued their own banknotes, and stopped any new banks from starting to issue notes across the UK.

Front page of the Bank Charter Act 1844

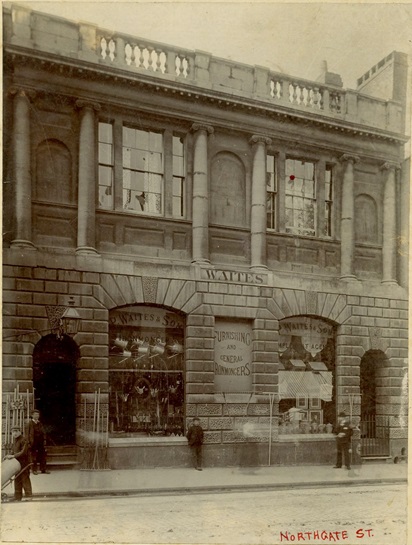

1834

Bank of England Plymouth branch opened

As more Bank of England branches opened across the UK, they began to be adapted to suit the economic conditions of different regions.

The Royal Navy requested that we open branches to assist with its banking needs and provide it with easy access to banknotes. This was one of the reasons for the opening of our Plymouth branch in 1834.

The Plymouth branch closed in 1949.

Street view of the Bank of England building in Plymouth

1826

First Bank of England branch opens

Bank of England branches were first established in 1826 as a response to the financial crisis of 1825 to 1826, which saw many country and provincial banks fail.

One of the main reasons for establishing branch banks was to enable us to take further control of the banknote circulation, in order to prevent another crisis.

The first Bank of England branch bank was opened in Gloucester on 19 July 1826. The branch was also one of the most short-lived, as it was never very profitable. The business was transferred to the Bristol branch in 1849.

Street view of the Bank of England in Northgate Street, Gloucester

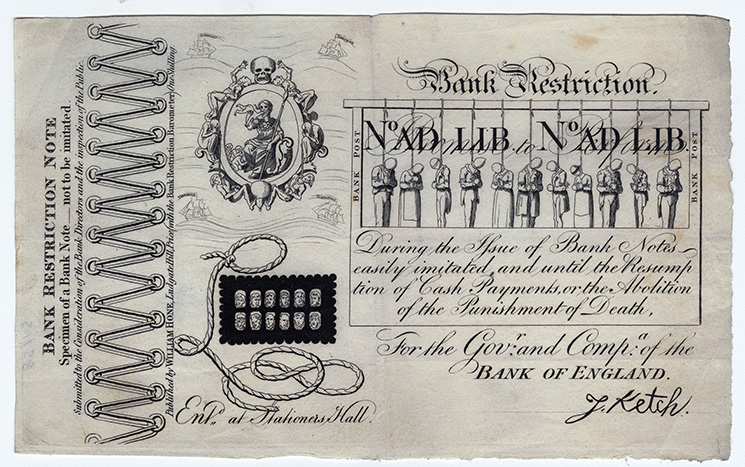

1797-1821

Forgeries in the Restriction Period

The Restriction Period (1797 to 1821) temporarily removed the Bank of England’s obligation to exchange banknotes for an equivalent value of gold. It was brought in due to a shortage of gold caused by overprinting of banknotes.

This period provided the conditions in which forgery could thrive, because the Bank of England issued low-denomination notes (£1 and £2) for the first time to compensate for the shortage of gold coin. These notes were handled by people who were not used to paper currency and who were often illiterate. They quickly became the natural dupes of the forgers.

Forgery of Bank of England banknotes was considered a capital offence, and over 300 people were hanged during this period. The Bank of England Archive contains much of the Freshfields Prison correspondence between the Bank of England and prisoners held on forgery charges.

Before the Restriction Period, forgers were more likely to attempt to alter the banknotes already in circulation, rather than print new ones. One example was to attempt to change the £10 note into a £20 note, ‘doubling’ its value.

Bank restriction note

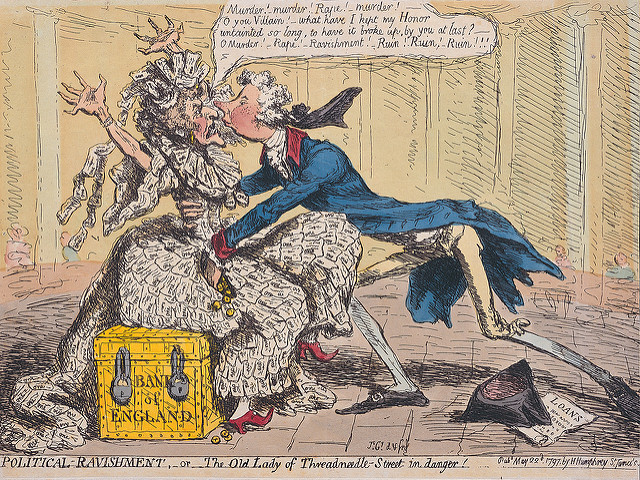

1797

The Restriction Period

In 1797 France declared war on Britain. When a small French force landed on mainland Britain, fears of invasion quickly spread. During this time, the public rushed to the Bank of England to convert their banknotes into gold, which was possible at the time. The amount of gold held by the Bank dropped from £16 million to just £2 million.

To try to preserve the already depleted gold reserves, the Prime Minster, William Pitt the Younger, placed a Privy Council Order on the Bank of England, ordering it to stop paying notes in gold.

This famous cartoon denotes William Pitt the Younger attempting to ‘woo’ the gold off an old lady representing the Bank of England. This was an effort to help fund the upcoming war with France.

From this date on, the Bank of England became known as the ‘Old Lady of Threadneedle Street’.

Cartoon of an old lady being kissed by a younger man

October 1788

Architect Sir John Soane is appointed

One of the UK’s greatest architects began his 45-year career at the Bank of England. He extended the Bank until it had doubled in size to 3.5 acres, and eventually enclosed it with a windowless wall in 1828.

The structure of Soane’s Bank of England remained more or less untouched until it was demolished and a new building erected by architect Sir Herbert Baker, between 1925 and 1939. However, Sir John’s outer wall remains in place to this day.

The minutes of meetings held by Sir John Soane and pictures of plans are part of the Bank of England Archive.

Sir John Soane portrait painting

1734

The Bank of England moves to Threadneedle Street

In 1734, the Bank of England moved to the site on Threadneedle Street where it still stands today. Slowly, over the next 100 years or so, the Bank bought adjacent properties until it owned the entire 3.5-acre site in the heart of the City of London.

Our first architect George Sampson created the first purpose-built bank in the UK on the site. It was said to be Palladian in style, identified by its symmetry and classic design.

Payment by the Bank to contractors for the balance of the new building in 1734 was £268, 17 shillings, and two pence.

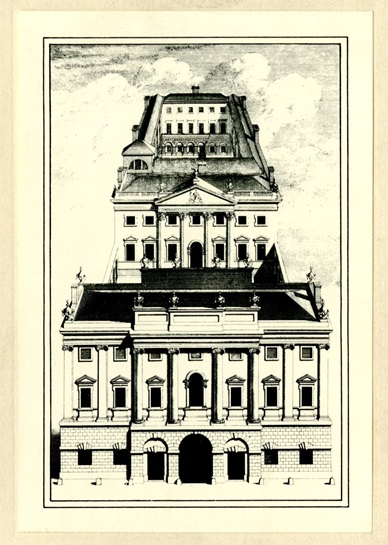

Exterior design of the Bank of England building

1725

First denominated banknotes issued

Before 1725, banknotes were hand written, often for the specific amount deposited by the customer. In 1725, we began to issue partially printed notes for amounts of £20 and upwards, in increments of £10. The highest denomination was £90. However, each denomination could be increased in value by a maximum of £9 19 shillings 11 pence (£9.99 pence) to reflect the actual amount of the deposit. The issuing cashier would increase the value of the note in writing.

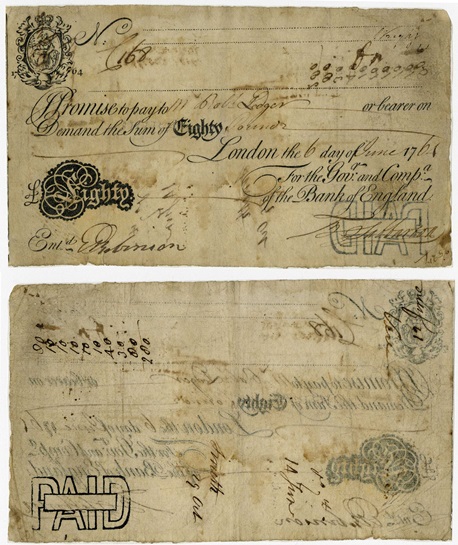

Front and back partially printed £80 note

1720

South Sea Bubble: the first financial crisis in the Bank of England’s history

In 1711, the South Sea Company was founded. Threatening the Bank’s position as the Government’s banker and owner of national debt, the South Sea Company exchanged loans to the Government for trading rights in Spanish-controlled South Seas (known now as South America). At this time, Britain was in the midst of war with Spain.

Very little trading occurred, but the South Sea Company set its sights on servicing the national debt, which was largely the Bank of England’s job at the time.

In 1720, the South Sea Company was granted part of the national debt and its stock price rose dramatically. This caused a frenzy of investment in its stock, but prices eventually crashed and thousands of people were ruined.

1694

Sir John Houblon becomes first Governor of the Bank of England

The Bank of England’s early years under Sir John Houblon were dominated by the Government's pressing demands for finance and the issue of a new coinage. The Bank also started a conventional banking business, accepting deposits from the public.

Between 1994 and 2014, Sir John Houblon was honoured on the £50 note.

Front design of £50 note

27 July 1694

Bank of England founded

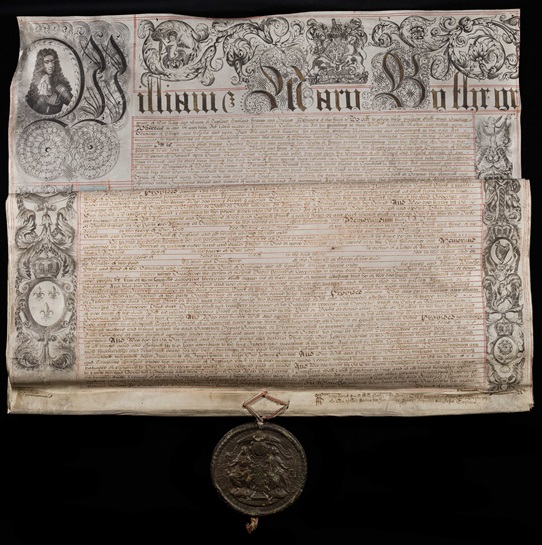

The Bank of England began as a private bank that would act as a banker to the Government. It was primarily founded to fund the war effort against France. The King and Queen of the time, William and Mary, were two of the original stockholders.

The original Royal Charter of 1694, granted by King William and Queen Mary, explained that the Bank was founded to ‘promote the public Good and Benefit of our People’.

In essence, this is still used today in our current mission statement: ‘Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability’.

The Bank of England opened for business on 1 August 1694 in temporary accommodation in the Mercers' Hall in Cheapside. It had a staff of just 17 clerks and two gatekeepers.

1694 manuscript of Bank of England Charter