What are cross-border payments?

Cross-border payments are financial transactions where the payer and the recipient are based in separate countries. They cover both wholesale and retail payments, including remittances.

Cross-border payments can be made in several different ways. Bank transfers, credit card payments and alternative payment methods such as e-money wallets and mobile payments are currently the most prevalent ways of transferring funds across borders.

The two main types of cross-border payments are:

-

Wholesale cross-border payments: These are typically between financial institutions, either to support the financial institution’s customers’ activities, or its own cross-border activities (such as borrowing and lending, foreign exchange, and the trading of equity and debt, derivatives, commodities and securities).

Governments and larger non-financial companies also use wholesale cross-border payments for large transactions generated by the import and export of goods and services or trading in financial markets.

- Retail cross-border payments: These are typically between individuals and businesses. The key types are person-to-person, person-to-business and business-to-business. They include remittances, most notably money that migrants send back to their home countries.

Why do cross-border payments matter?

Over the past few decades, the increased international mobility of goods and services, capital and people has contributed to the growing economic importance of cross-border payments. The value of cross-border payments is estimated to increase from almost $150 trillion in 2017 to over $250 trillion by 2027, equating to a rise of over $100 trillion in just 10 years.

Factors that have been intensifying over recent years include:

- manufacturers expanding their supply chains across borders

- cross-border asset management and global investment flows

- international trade and e-commerce

- migrants sending money via international remittances

These trends have increased the demand for cross-border payments and the need for end users to have access to cross-border payment services that are as efficient and safe as comparable domestic services. Remittances in particular play a vital role in low and middle-income economies and in some cases are becoming the primary source of development finance.

Growth and revenue expansion is also driving competitive interest in this market. Innovative new business models and participants are emerging in response.

How do cross-border payments work?

Currencies are closed-loop systems. Domestic payment systems are not traditionally directly connected with the systems of other countries so when making a transfer between two jurisdictions, the currency is not physically transferred overseas.

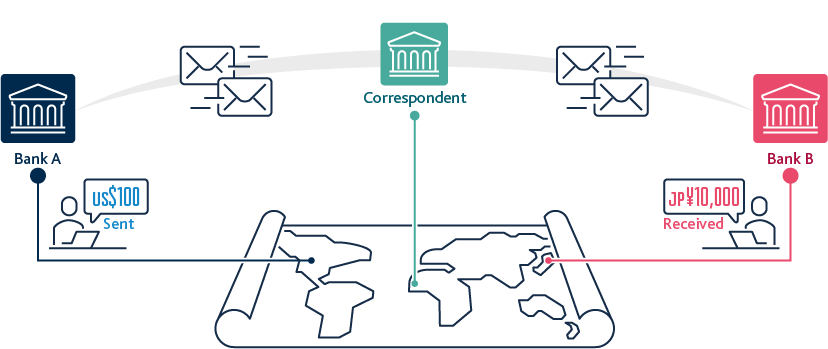

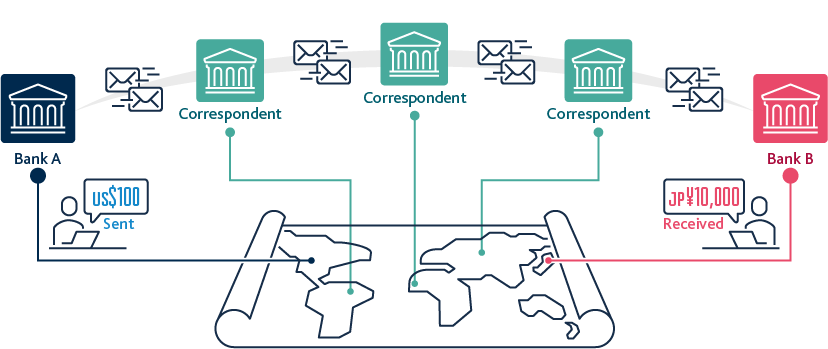

Instead, international banks provide accounts for foreign counterparts and have their own accounts with their foreign counterparts, which enable banks to make payments in foreign currency. The funds are not sent across borders; instead accounts are credited in one jurisdiction and debited the corresponding amount in the other. Other payment providers such as Fintechs and money transfer agents use this interbank network to provide payment services to businesses and individuals.

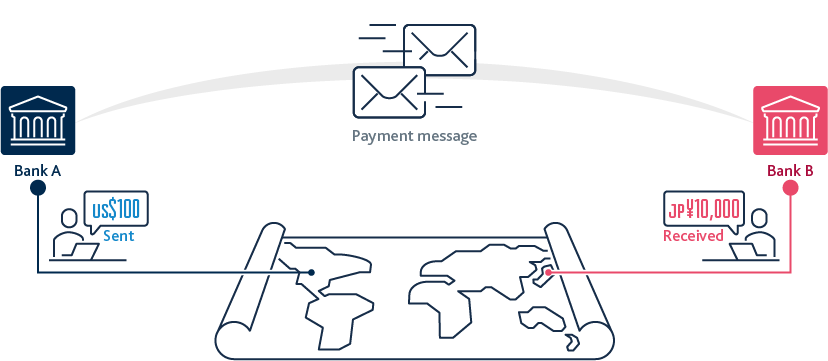

For example, in Figure 1 Bank A will send a message to Bank B instructing them to make a payment for a customer. Bank B will then credit the end customer’s account with money from the account Bank A holds at Bank B.