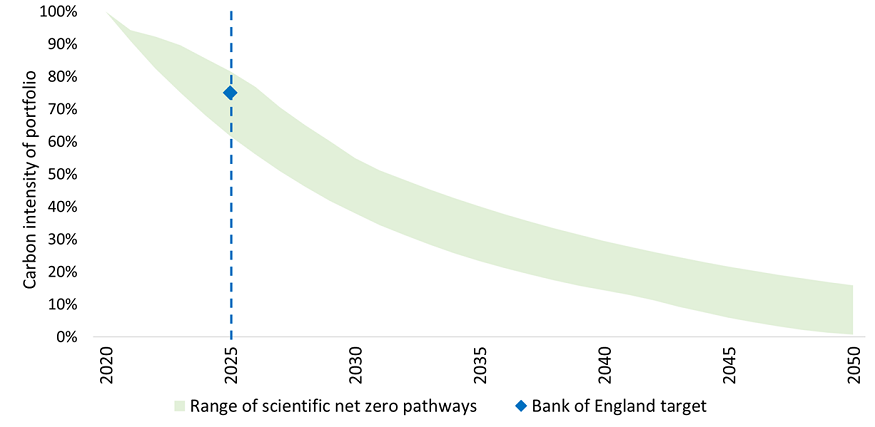

The chosen horizon for our interim target seeks to balance: our focus on sustained changes in companies’ behaviour and allowing time for incentives to take effect; accountability and transparency; and consistency with guidance from existing net zero investment frameworks. The balance of feedback we received also supported such a horizon - short term targets would not allow incentives time to take effect, while interim targets at much longer horizons run the risk of becoming out of date and losing relevance long before they are reached.

Over time, we will also look to purchase eligible green corporate bonds, though we have chosen not to have an associated target.

Eligibility for purchase

As set out in our discussion paper, we are mindful, in greening our eligibility criteria, that transition is not well served by climate-conscious investors indiscriminately ceasing to invest in firms which are currently high emitters. This would cede influence over sectors of the economy that are crucial to overall transition to other investors, who may care less about climate considerations. It would also fail to differentiate between firms which have credible plans for emissions reduction and those which do not, thereby failing to incentivise putting such plans in place. We have identified two key ways in which our criteria determining eligibility for purchase by the CBPS can incentivise firms to improve their climate behaviours.

- We will incentivise firms to measure and disclose their exposures to climate risks and to devise and communicate net zero aligned decarbonisation plans. This complements and reinforces the Government’s pathway to mandatory disclosures. It also accords with a strong onus in the feedback we received on the fundamental importance of investors having access to more, and higher quality, data on firms’ climate impacts.

- We will take action to filter out certain activities that scientific evidence suggests are incompatible with reaching net zero by 2050, or from when Government policy is for very tight restrictions on these activities. Other net zero investment frameworks advocate such an approach, with the producers of these highlighting this in their feedback.

For instance, a strong body of evidence supports the need for a rapid fall in thermal coal usage – including elimination by around 2030 – in order for advanced economies to be aligned with transition to net zero. In the UK, the Government has committed to eliminating unabated coal-fired power generation by 2025.

That is why we will make ineligible for CBPS purchase debt issued by firms:

- Without a climate disclosure compatible with UK mandatory requirements which, on current Government proposals, will be introduced for financial years beginning after April 2022;

- In the high emitting energy and utilities sectors which have not published an emissions reduction target, with effect from the November 2021 reinvestment round;

- Not satisfying a set of stringent restrictions on the use of thermal coal, also with effect from the November 2021 reinvestment round.

Tilting

A powerful tool for further incentivising a reduction in emissions is skewing, or ‘tilting’, future CBPS purchases within sectors towards the debt of eligible firms that are performing relatively strongly in support of net zero - and responding most to the incentives we are setting – and away from those who are not.

- A scorecard allocating firms to different climate buckets will be used to assess their performance across multiple climate metrics, and to drive our investment decisions.

- This scorecard will include the latest level of a firm’s carbon intensity and recent changes in its emissions, as well as metrics of credible transition plans for the future. For 2021, these forward-looking metrics will include the publication of climate disclosures and decarbonisation targets (taking account of third-party verification).

- We believe these metrics strike the appropriate balance between incentivising firms to produce more ambitious and credible plans for emissions reduction and having good data coverage across CBPS issuers to ensure firms can be fairly compared to each other. We have focussed on metrics that are sufficiently robust as a basis for investing public funds. As other measures of climate performance expand their coverage and demonstrate their robustness over time, we will look to incorporate them. We received feedback noting the flexibility of tilting approaches, into which new and improved metrics can be incorporated in a timely way.

More specifically, the overall climate bucket to which a firm is allocated, which will affect the price the CBPS is prepared to pay for its bonds, will take into account:

i. Current carbon intensity: Carbon intensity normalises a firm’s greenhouse gas emissions by its revenues, to capture the volume of emissions it produces for its size, rather than how large a company it is. This metric is expressed in terms of the volume of carbon dioxide equivalent emissions per million pounds of revenue.

ii. Past change in absolute emissions: To be calculated as a weighted-moving average over a three year lookback window, with more weight placed on the most recent data. Firms’ progress will be compared against transition pathways judged most appropriate for a given sector. Sector specific pathways will be used where available and sufficiently robust (currently the Net Zero Asset Owner Alliance pathways for energy and utilities - electricity, gas and water - sectors). We will otherwise use an aggregate pathway (from the NGFS).

Where firms have not self-reported emissions data, such that only estimates produced by third-party data providers are available, they will be allocated to the weakest bucket of performers in terms of both carbon intensity and reductions in absolute emissions.

iii. Disclosure: Firms will receive credit for having made climate-related financial disclosures, the more so where they are in a sector with relatively low levels of disclosure. Firms will be marked down for not having made such disclosures, particularly if they are in sectors with higher levels of disclosure.

iv. Targets: Firms will receive credit for having an emissions reduction target, the more so if it has been validated by a third party. Firms which do not have a target at all will be marked down, especially where there is a higher coverage of targets in their sector.

The buckets firms are allocated to for each of these four metrics will then be weighted together to allocate them to an overall climate category. Figure 2.3 illustrates how this approach will operate. All else equal, we will be prepared to pay a higher price for bonds issued by greener firms. These will then comprise a greater proportion of new purchases and, over time, the CBPS portfolio. Tilting will occur within sectors. Weights on the forward-looking metrics (i.e. disclosures and targets) will be greater where coverage in a sector is higher, so as not to overly penalise firms who are not lagging behind their sector peer group.

Figure 2.3: Tilting scorecard and its effect on CBPS investments

Current carbon intensity

|

Reduction in emissions

|

Climate disclosure

|

Validated science-based target

|

|

Firms scored relative to the carbon intensity of the portfolio.

|

Firms scored relative to a reference transition pathway most appropriate for a sector.

|

Firms receive credit for publishing a climate disclosure.

|

Firms receive credit for publishing an emissions reduction target – more so if verified.

|

|

For each sector, equal weight is placed on the level of carbon intensity and past reductions in emissions.

|

Scores - and the weight given to each category - vary relative to peer group performance.

|

| Firms are allocated to a bucket based on their climate performance. Purchases are then tilted within sectors towards better climate performers by linking these buckets to the price we are willing to pay for a bond issued by a firm. |

For a picture showing a (stylised) version of a tilt in action please see our discussion paper.

Our intention is to place progressively more weight, over time, on forward looking metrics, and to make use of developments in metrics to increasingly capture the ambition and credibility of firms’ transition plans.

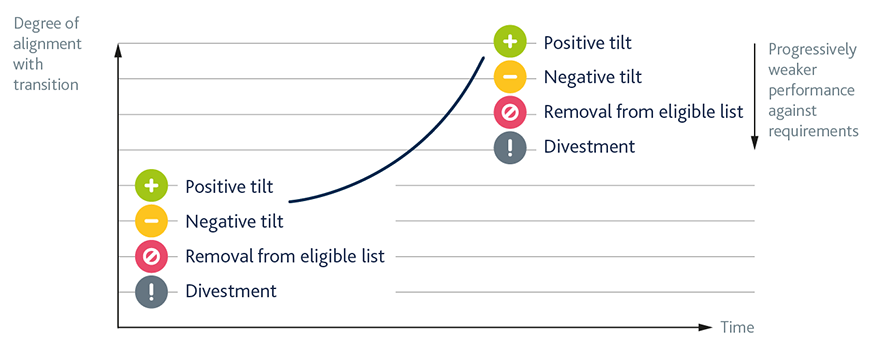

Escalation

We need to ensure that the incentives we set for firms to change their behaviours remain binding as transition progresses. Our requirements will therefore tighten over time as improvements in data quality and coverage allow us to distinguish more effectively between firms on the basis of the ambition and credibility of their future transition plans. Specifically:

- The weight placed on forward-looking metrics within our scorecard will increase over time, as coverage broadens;

- We will also explore options for capturing more granular information on the quality of firms’ disclosures and the ambition of firms’ emissions reduction targets.

As well as progressively tightening our overall requirements, we also have an ‘escalation ladder’ of actions we can take against specific firms whose climate performance is not sufficiently strong. Figure 2.4 summarises this set of actions. These include tilting purchases away from weaker climate performers, making them ineligible for further purchases and, if appropriate, divestment of existing holdings of their debt. The upward sloping line represents our overall requirements becoming more demanding over time.