Overview

This section of our Market Operations Guide provides more detail on the market operations we use to achieve our monetary policy and financial stability objectives. It also covers how firms can apply for access and make use of them. Our ‘open for business’ approach means that where eligible firms meet our supervisory threshold conditions and have appropriate collateral, they can apply for access to our facilities.

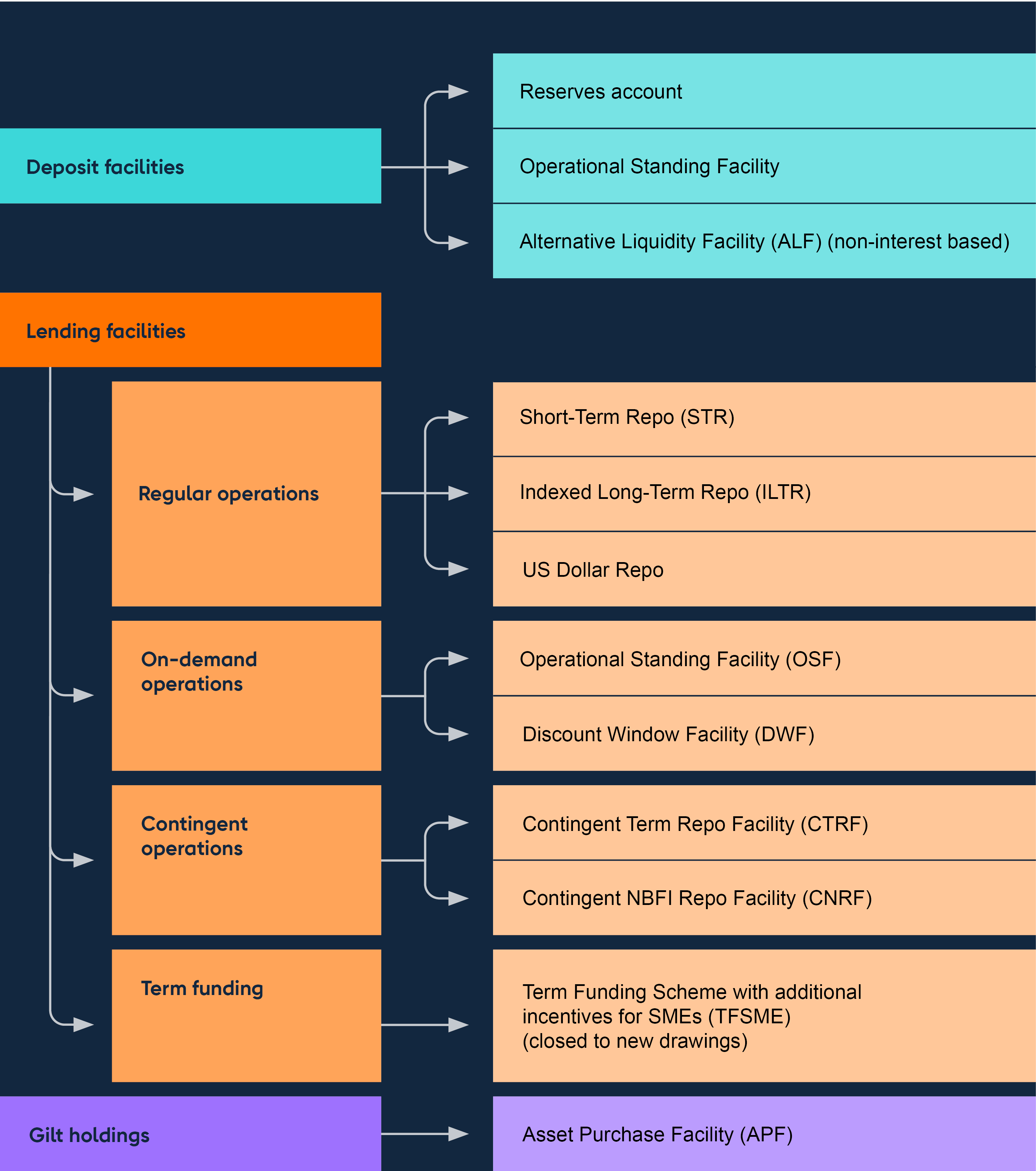

Table A: Our sterling lending facilities at a glance

| Facility | Purpose | Terms | |

|

Regular |

Short-Term Repo |

A source of reserves for payments and precautionary reasons |

|

|

Indexed Long-Term Repo |

A source of reserves for payments and precautionary reasons |

|

|

|

On-demand |

Operational Standing Facility |

A bilateral tool to manage liquidity demand shocks, such as short-term payment frictions |

|

|

Discount Window Facility |

A bilateral source of highly liquid assets for the purposes of liquidity management |

|

|

|

Contingent |

Contingent Term Repo Facility |

A contingent source of reserves in a scenario of actual or prospective market-wide stress |

|

|

Contingent Non-Bank Financial Institution Repo Facility |

A contingent source of cash to address episodes of severe gilt market dysfunction |

|

Operational readiness

Operational readiness and resilience are areas of importance for us. For example, the PRA issues guidance and rules for the firms it regulates concerning this. As part of our role in markets, we undertake our own work to ensure that we are operationally ready and resilient. We conduct regular testing across a range of different market activities, on an ongoing basis.

How to be ready to participate in Bank operations

- Test all facilities you are signed up to regularly to ensure you are ready to use them, and you are familiar with both systems and settlement processes.

- Ensure multiple users maintain access to, and familiarity with, our electronic trading system (Btender) and the Collateral Management Portal (CMP) to facilitate straight through settlement and management of securities collateral.

- Familiarise yourself with the Bank’s collateral framework, eligibility criteria and haircuts.

- Plan ahead of collateral pre-positioning; in particular for loan pools and securities which require time to complete the due diligence process.

- Be aware that you can choose to net cash payments in the Bank’s operations, making settlement more efficient.

- Refer to the operational and pre-positioning guides.

See Information for participants and the Sterling Monetary Framework (SMF) Operating Procedures for further information on how to align processes with the Bank’s requirements.

Regular testing of the Bank’s facilities is crucial for maintaining operational readiness, and helps to identify potential issues. The Bank expects participants’ own risk frameworks to mandate frequent testing. Participants are currently required to test their access to SMF lending facilities (STR/ILTR and DWF) at least every two years. The Bank may update its testing requirements, may request additional tests, and will accommodate testing requests from participants where possible.

Submitting bids in our market operations

SMF open market operations and Asset Purchase Facility (APF) auctions are conducted using our electronic auctioning system, Btender. If Btender is unavailable, announcements will be made via our SMF wire services page and our APF wire services page. If you experience issues accessing Btender, please contact the Sterling Desk.

Our expectation is for firms to use Btender in all circumstances to minimise operational risk. Where this is not possible, firms may submit proxy bids.

If a proxy bid is required: on auction day, firms should:

- Call +44 (0) 20 3461 5000 to confirm the bid.

- Then email: proxybids@bankofengland.co.uk, including the name of the auction in the subject header field when submitting their proxy bid.

Alternatively, firms may submit proxy bids via a pre-existing Bloomberg IB chat room with the Sterling Desk. To set up an IB with the Sterling Desk, please contact your relationship manager or email Markets-SMDDealers@bankofengland.co.uk.

Firms should allow sufficient time before the end of the auction window to allow proxy bids to be processed by the Bank. All proxy bids will be processed on a best endeavours basis, and at the risk of the participant.

We reserve the right to take further steps to confirm firm eligibility, and verify the identity of submitting dealers, before accepting proxy bids. We accept no liability for delays arising from such checks.

Managing risk

When we lend to firms, we naturally incur risk. To protect public money, we manage the risk incurred by our SMF facilities in three ways:

- First, by applying appropriate eligibility criteria. To be eligible to participate in the Bank’s operations, firms must be subject to robust supervisory oversight by the Prudential Regulation Authority (PRA) or a comparable prudential regulator. This oversight provides an important assurance that we are lending only to firms that meet minimum prudential standards.

- Second, by applying collateral requirements. When we lend through our facilities, we manage our counterparty risk to the borrower by securing our lending against collateral posted by the borrowing firm. That collateral is subject to prudent haircuts.

- Third, the Bank must limit the risk that the terms on which it supplies reserves reduces incentive for firms to appropriately manage their own liquidity risk, or that the Bank’s operations disintermediate private markets. We do so by operating via a framework that delivers an appropriate balance between liquidity provision directly through the Bank’s facilities and indirectly through core markets, whose resilience in normal times and in stress is critical for monetary and financial stability.

Other facilities that do not fall under the SMF have appropriate eligibility criteria to manage the risk they incur.