How do we know how much prices have changed?

Every month a team of specialists collects around 180,000 separate prices of over 700 items covering everything a typical family might buy, such as milk, bread and bananas.

In the 30 years between 1990 and 2020 the price of a typical ‘basket’ containing all of these items roughly doubled.

But within that basket, the price of some items has gone up much faster than that. The price of other items has hardly changed at all. And some things have got cheaper.

Let’s look at the price of the items we mentioned earlier – milk, bread and bananas.

The price of a pint of milk and a loaf of bread has roughly doubled since 1990. Meanwhile, the price of bananas has gone down over that period.

Pint of milk

1990

25p

2020

42p

Loaf of bread

1990

50p

2020

£1.07

Kilo of bananas

1990

£1.18

2020

80p

What is inflation and why is a high rate of inflation harmful?

Think of a shopping basket filled with things we typically buy. Inflation is the rate of increase in the price of that basket of items.

A little bit of inflation is helpful. But high and unstable rates of inflation can be harmful.

If prices are unpredictable, it is difficult for people to plan how much they can spend, save or invest.

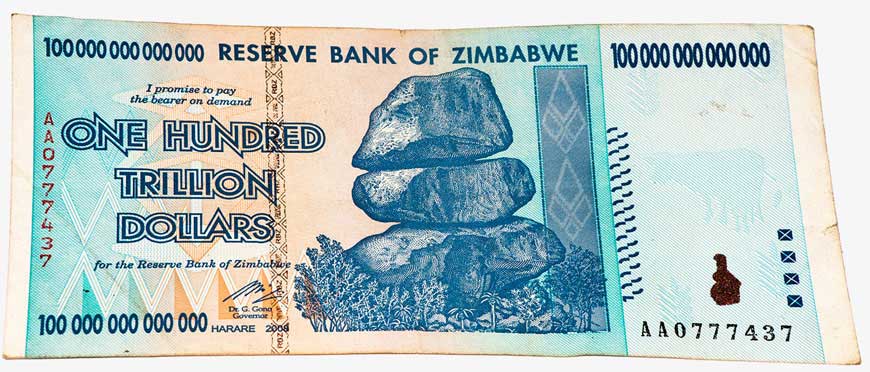

In extreme cases, high and volatile inflation can cause an economy to collapse. Zimbabwe is a good example. It experienced this between 2007 and 2009 when the price level increased by around 80 billion per cent in a single month.

As a result, people simply refused to use Zimbabwean banknotes and the economy ground to a halt.

How do we make sure prices don’t rise too quickly?

Here at the Bank of England it is our job to make sure that there’s a limit to prices rising, as this supports a stable and healthy economy.

We have a 2% target for inflation (given to us by the Government). The price of some things might go up by more than others – and some prices might go down but on average the price of items in the shopping basket should go up by 2% each year if we are meeting our target.

We work to keep inflation at our target by influencing interest rates. That’s because interest rates have an impact on how much spending there is in the economy, and how that feeds through to prices in the shops.

We can influence interest rates by:

- setting the UK’s main interest rate (Bank Rate)

- creating money to buy bonds (quantitative easing or ‘QE’)

Since the Government set us an inflation target in 1997, inflation has averaged about 2%.

The UK’s inflation rate has sometimes gone a bit above or below this figure over the years. But we have always brought it back to the target.