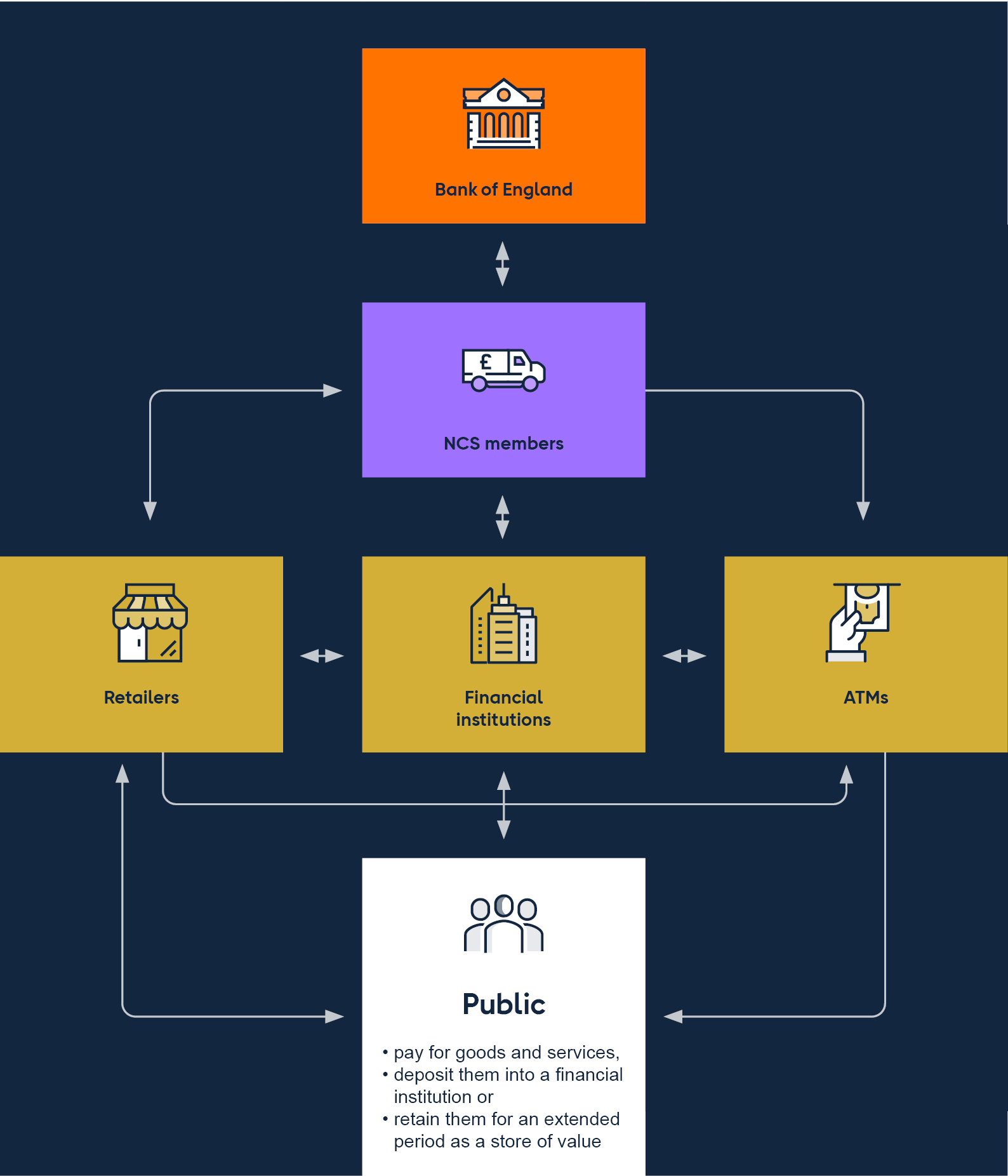

The Bank of England and Note Circulation Scheme (NCS) members are responsible for the UK's wholesale cash distribution infrastructure.

• De La Rue, the Bank’s contracted printer, produces Bank of England banknotes.

• Bank of England cash centres store new notes, and process and destroy unfit returns.

• When required, notes are collected by a member of the (NCS) from a Bank of England cash centre.

• Notes are then held at NCS centres and withdrawn when needed to meet customer demand. NCS members supply operators of ATMs, Bank and Post Office branches, retailers and foreign exchange companies. In the UK, most cash enters circulation via ATMs.

• The public (the UK population, as well as international persons) use banknotes either to i) pay for goods and services, ii) deposit them into a financial institution or iii) retain them for an extended period as a store of value.

• Retailers and bank branches deposit cash takings by transporting their notes via a Cash in Transit provider to their NCS Member. NCS members reconcile and sort the notes, reissuing fit notes and returning old/unfit banknotes back to the Bank for destruction (to be replaced with new).

Note the Royal Mint, on behalf of HM Treasury, issues UK coin to the NCS members under separate arrangements. However, the Bank of England’s upcoming legislative powers (see below) will apply to both the wholesale distribution of banknotes and coin.