While bank credit had generally remained accessible, contacts reported that conditions had tightened in the automotive and metal sectors, in addition to construction, retail and casual dining. Large corporates in particular continued to have ready access to cheap credit from banks and capital markets, although there were isolated reports of short-term finance becoming tighter due to Brexit uncertainty.

Some other forms of finance, such as asset based lending and peer-to-peer lending, also remained readily available. However, some larger peer-to-peer lenders had tightened lending criteria. The availability of trade credit insurance tightened further in the retail and construction sectors. In recent months, availability had also tightened for companies in the food supply chain, automotive supply chain, metals and recruitment.

There was some stress in retail, construction and consumer-facing sectors such as restaurants and car dealerships. This was leading to increased debt restructuring work and insolvencies, which nonetheless remained at low levels.

Demand for credit remained subdued among small and large companies, reflecting uncertainty about the economic outlook and some de-risking.

However, among small and medium-sized enterprises (SMEs), there was a pickup in demand for working capital in the form of unsecured borrowing and short-term overdrafts to support cashflow.

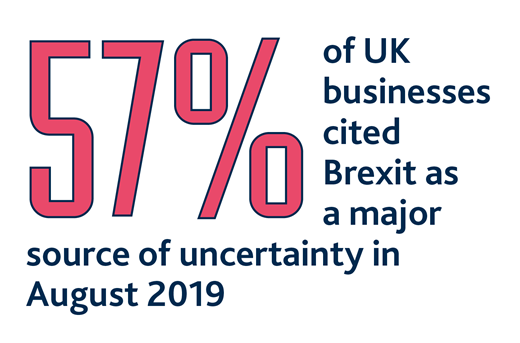

There were some reports of external funding being required to finance stockbuilding. The Agents’ Brexit survey suggested that Brexit contingency planning had increased the working capital needs of just over one-third of respondents, although most firms had financed that internally (Box 1).