Conference highlights

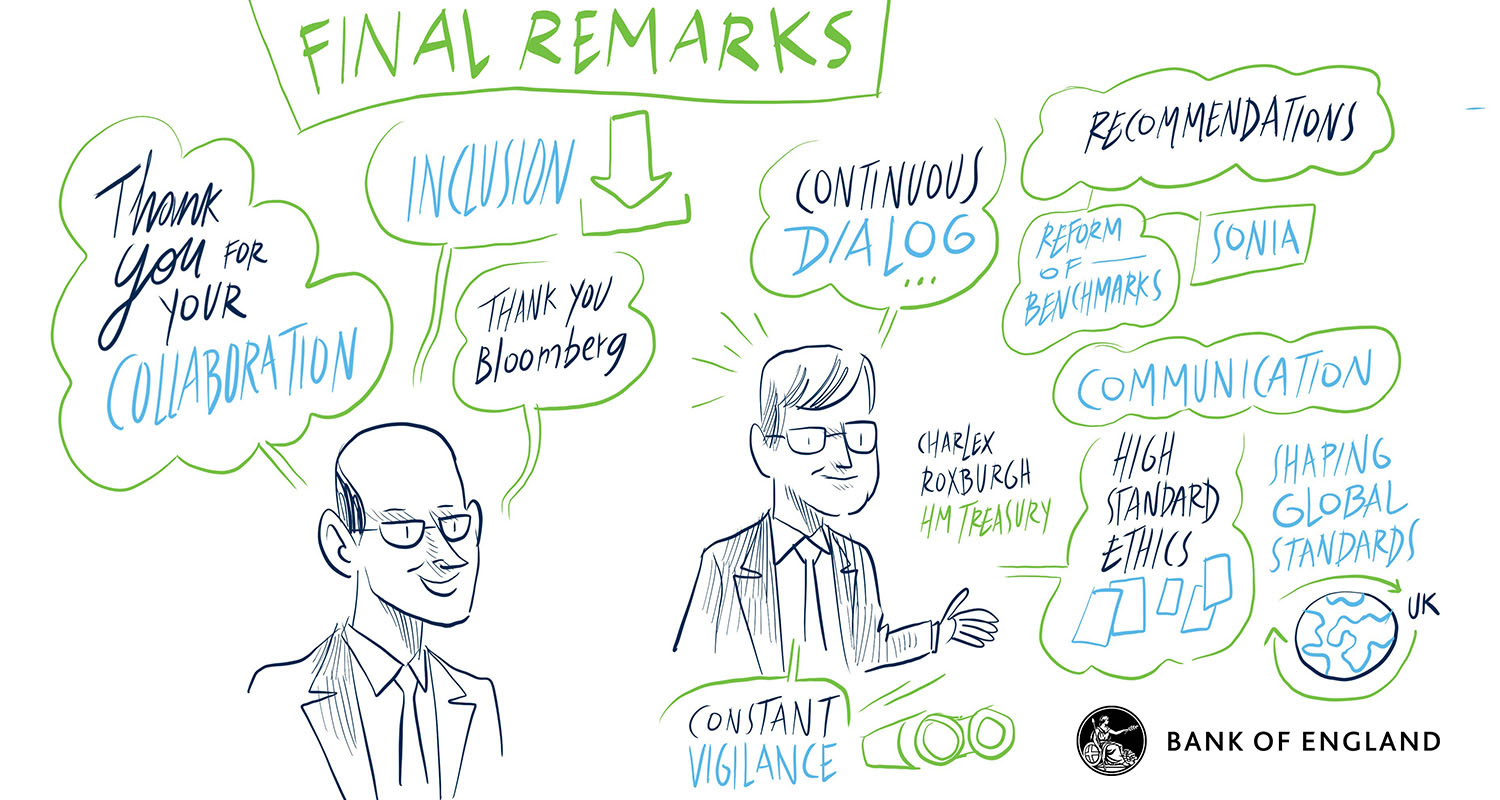

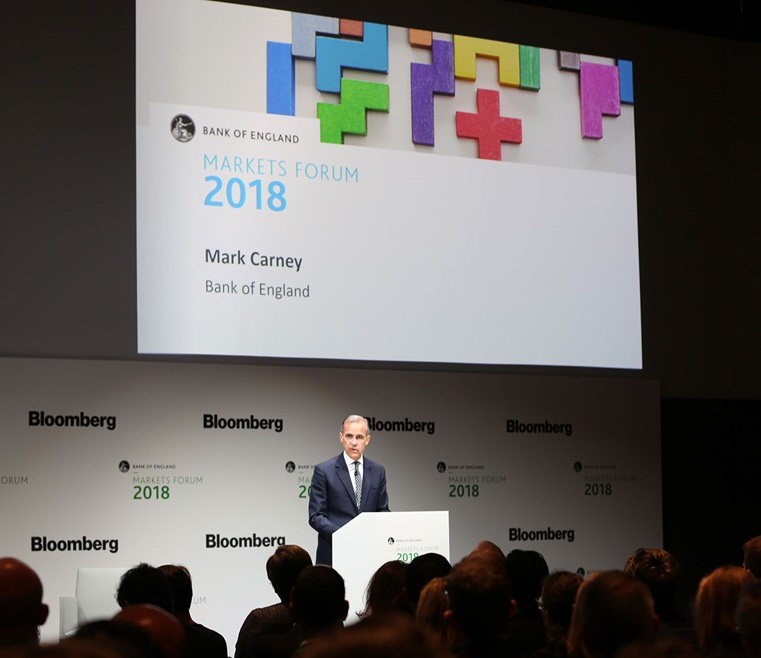

Markets Forum 2018 marked three years from the publication of the Fair and Effective Markets Review (FEMR). At the Forum, the Bank of England, along with the Financial Conduct Authority and HM Treasury, took stock of what has been achieved under the FEMR agenda so far, and scanned the horizon for emerging issues.

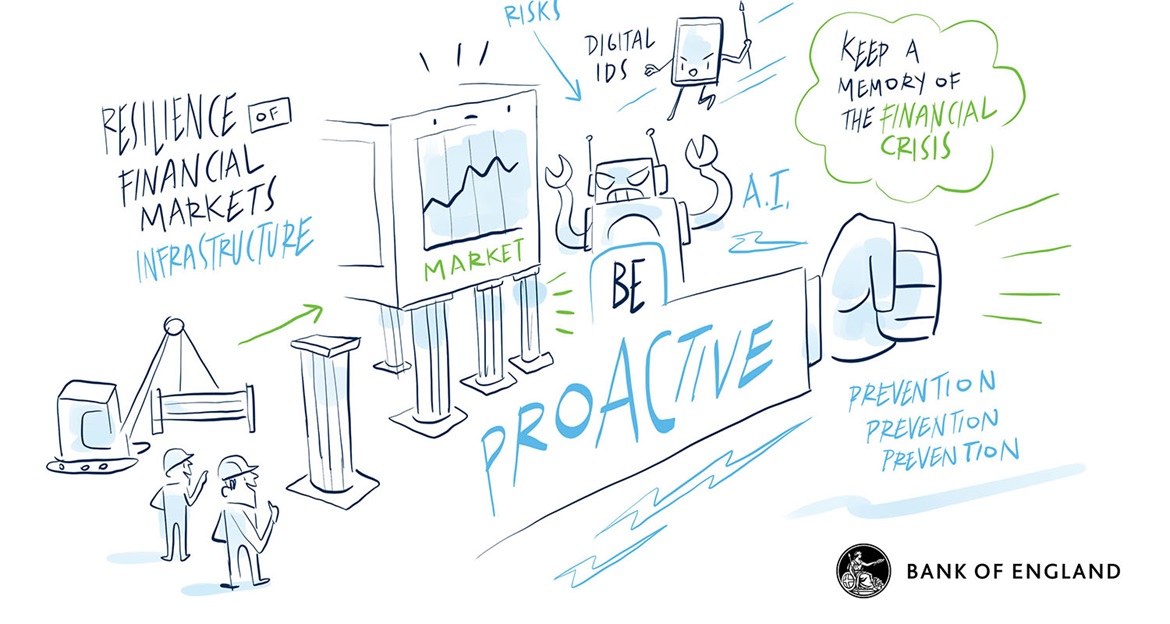

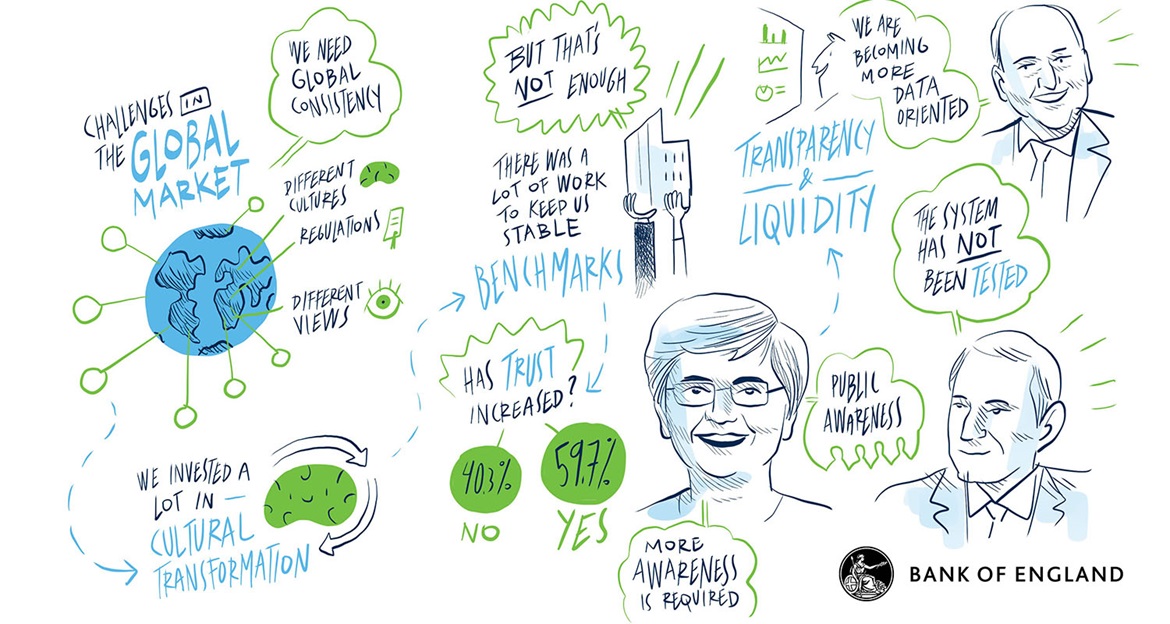

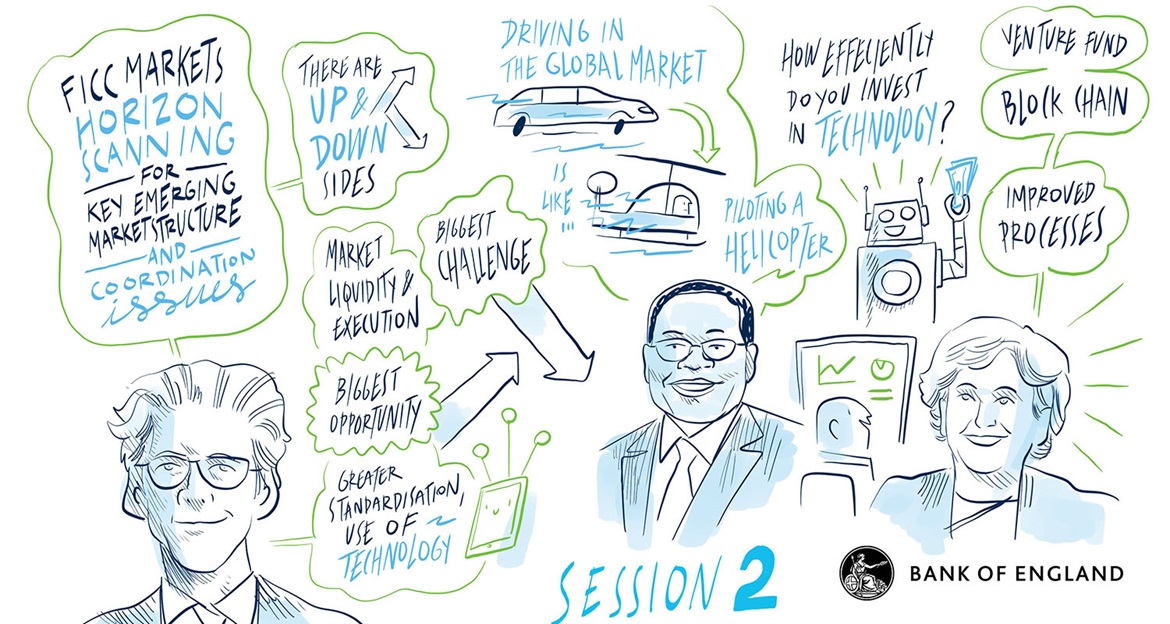

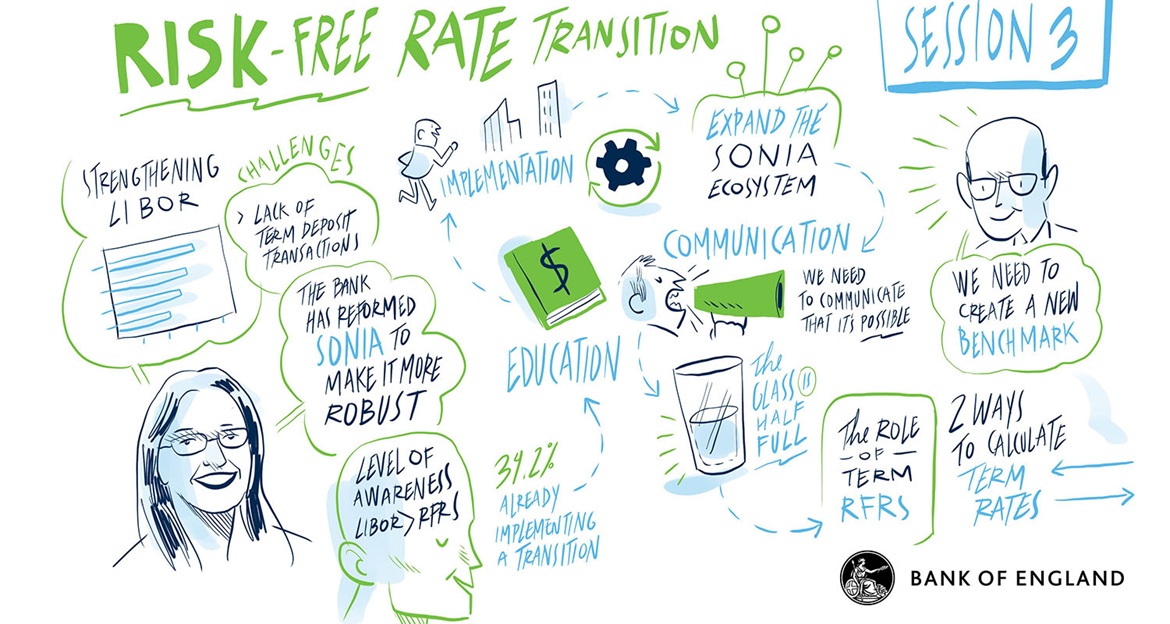

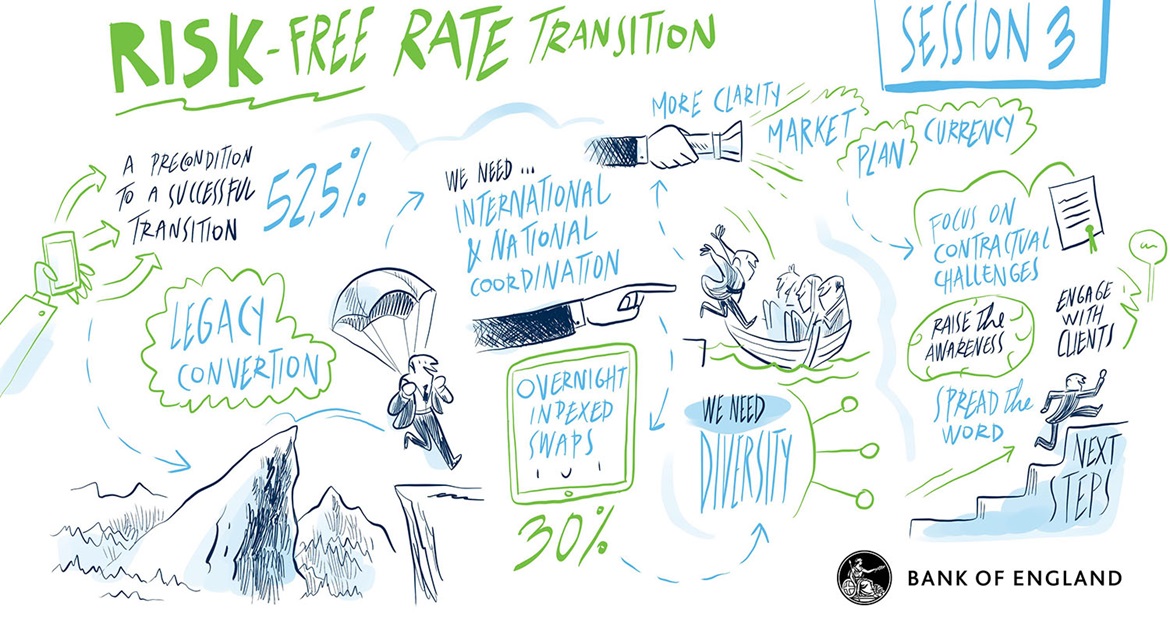

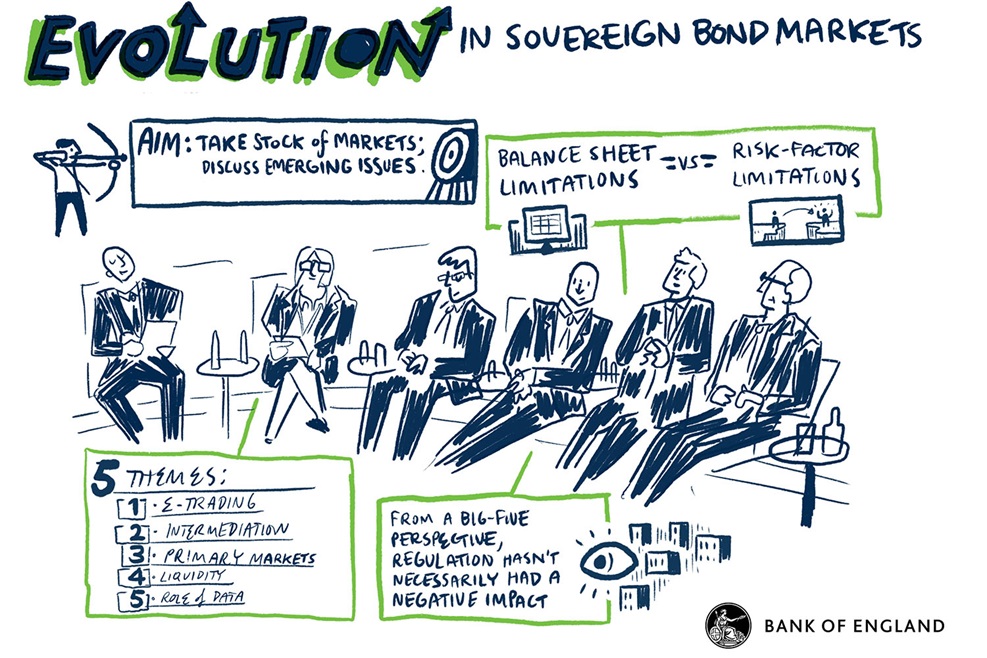

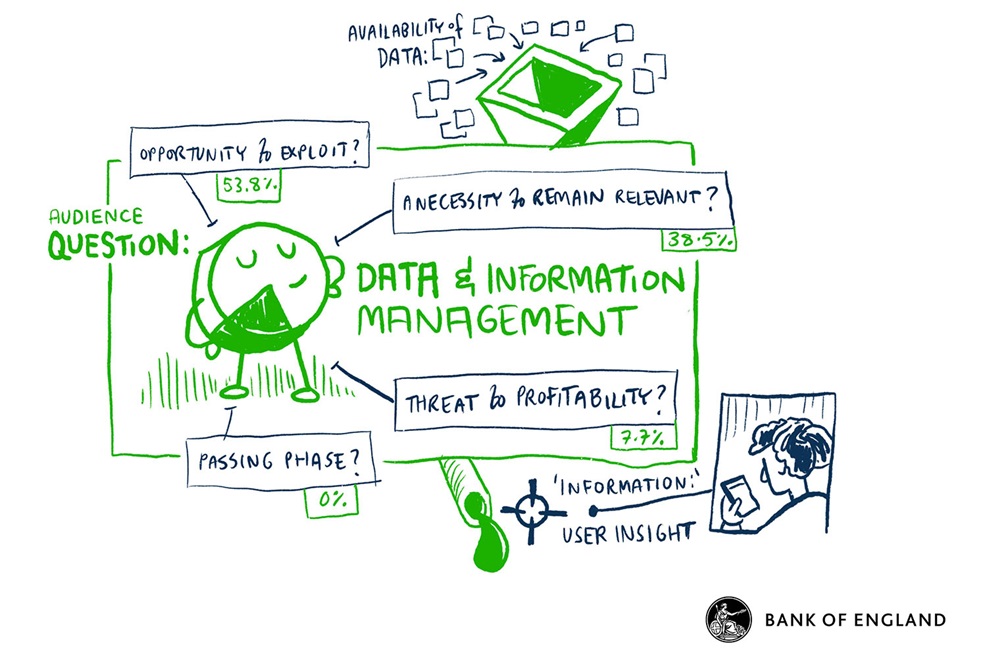

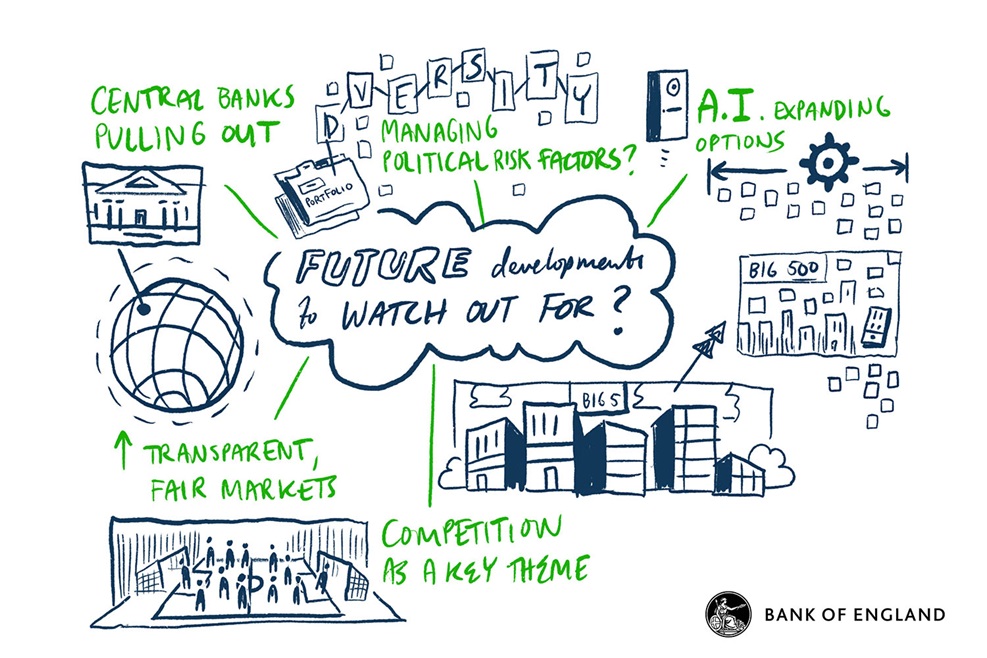

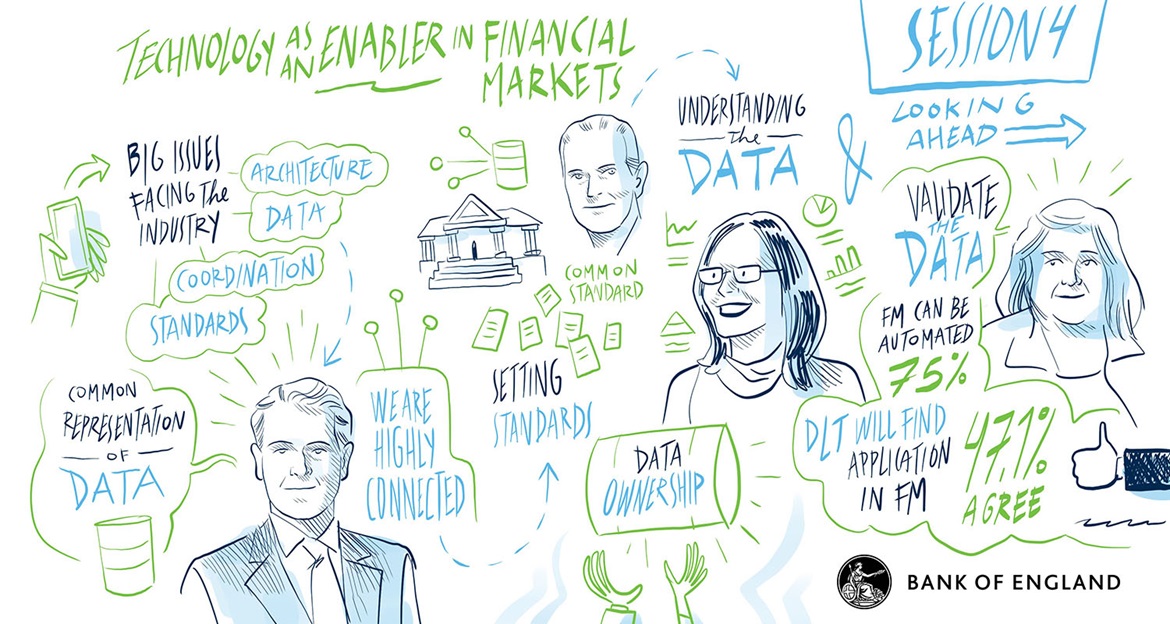

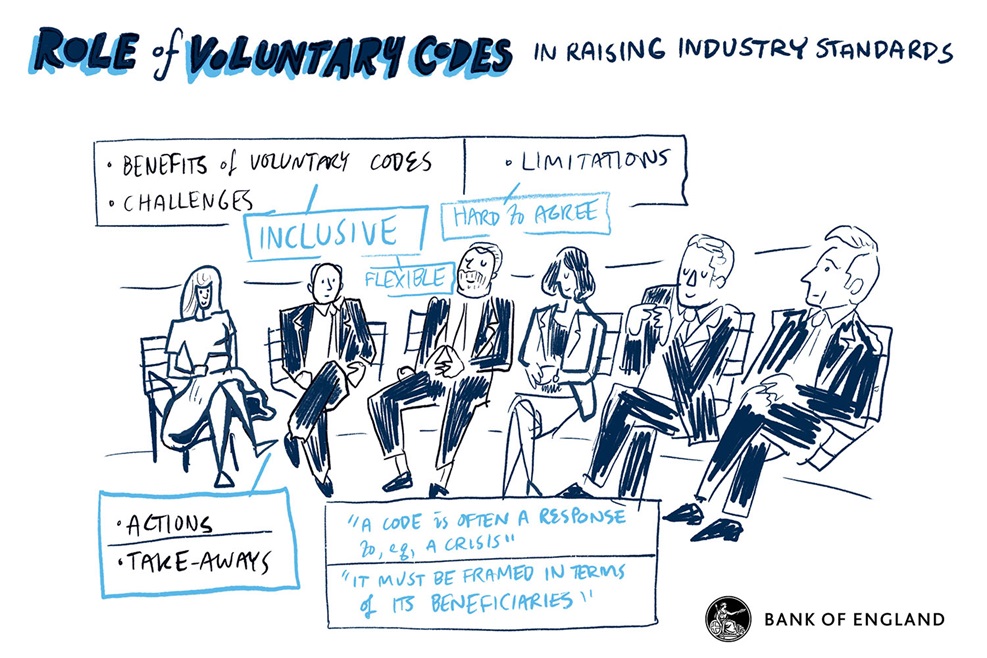

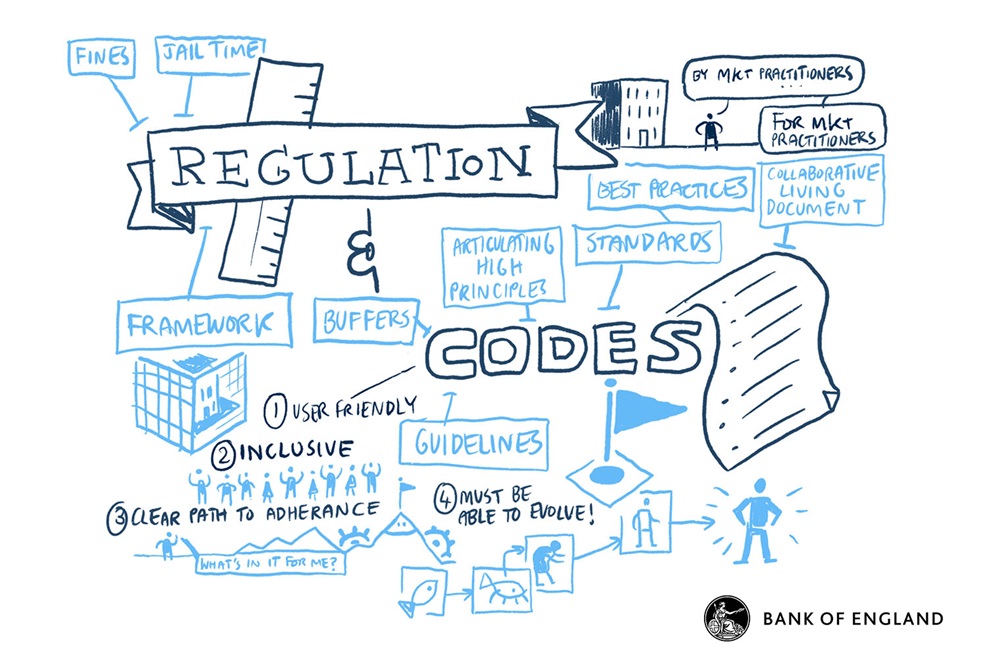

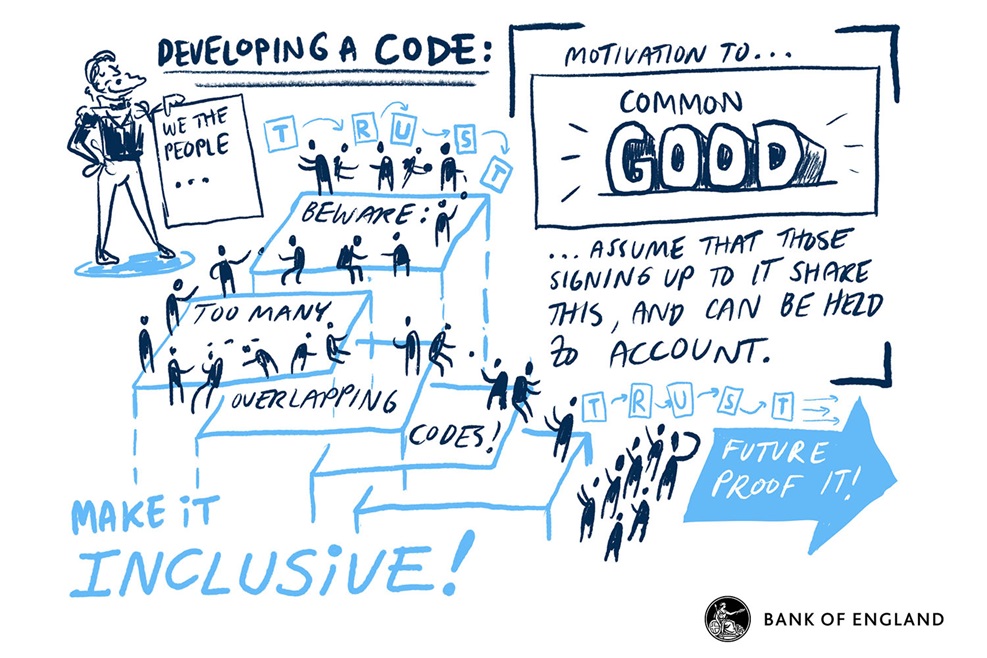

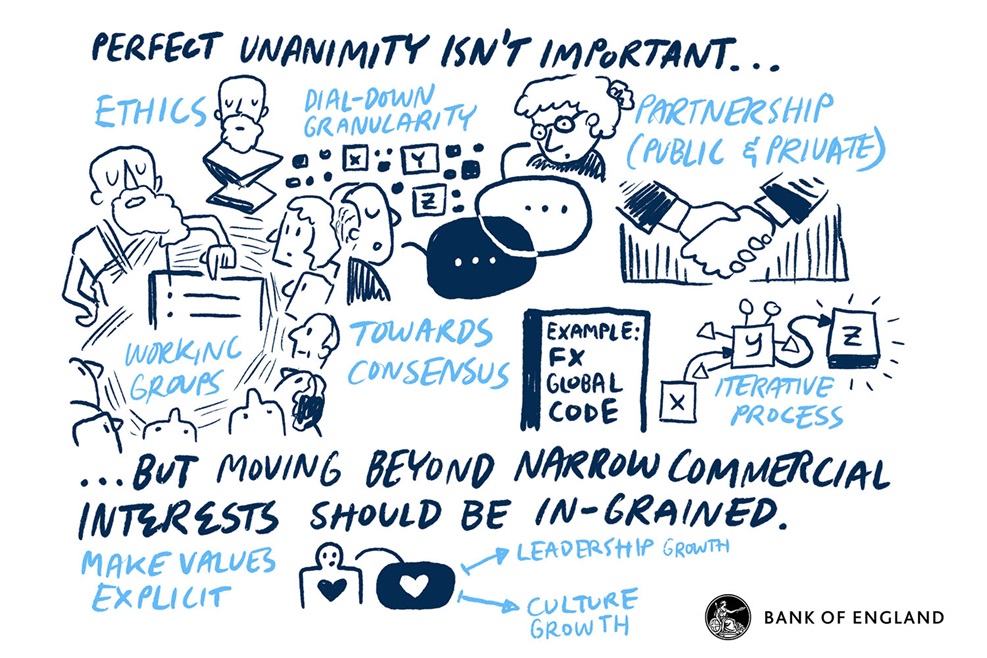

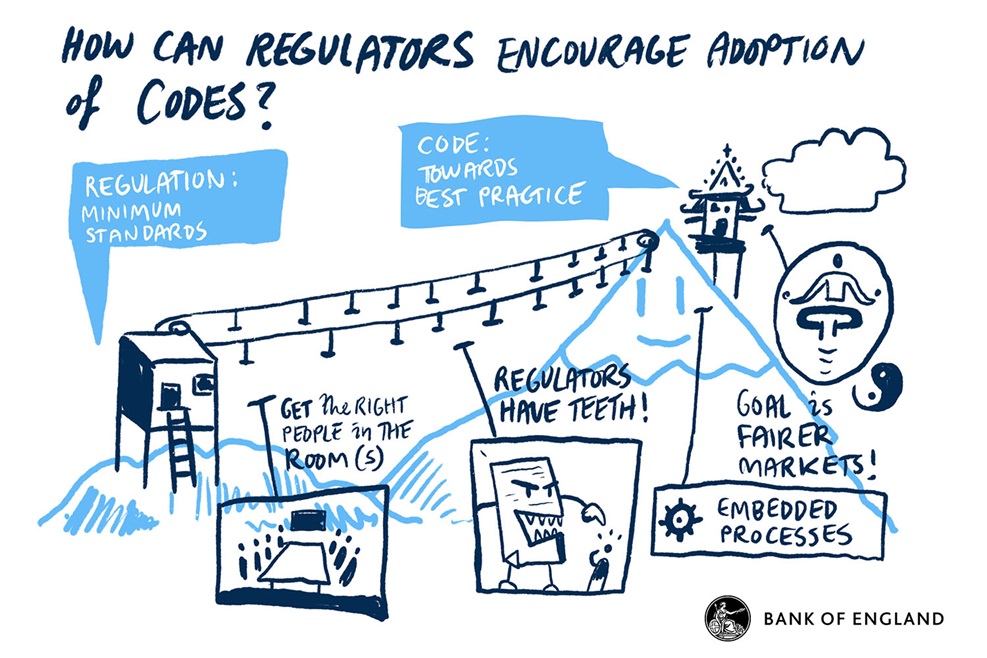

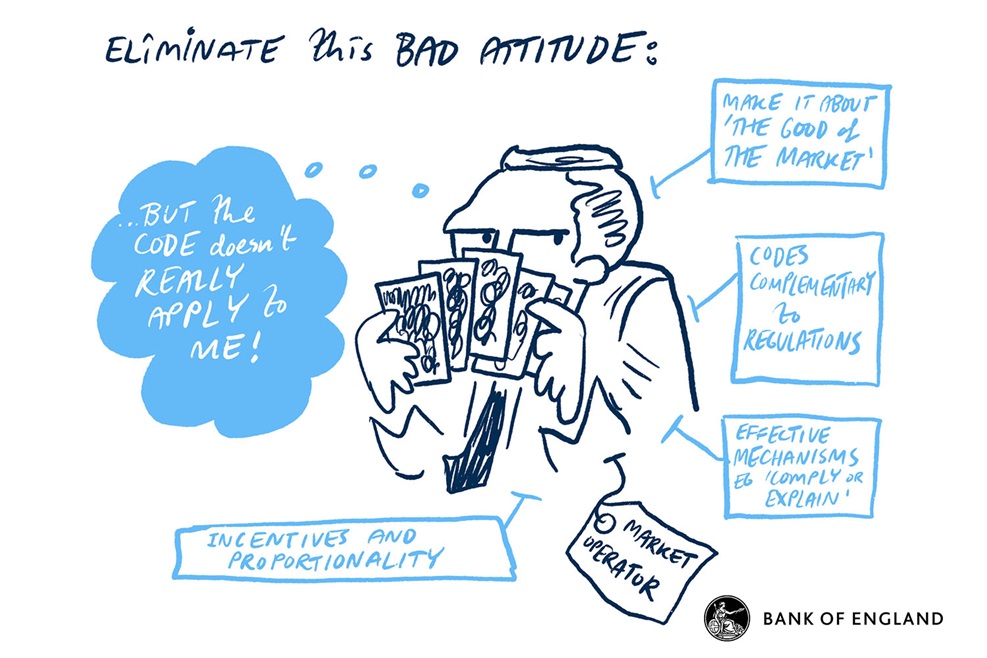

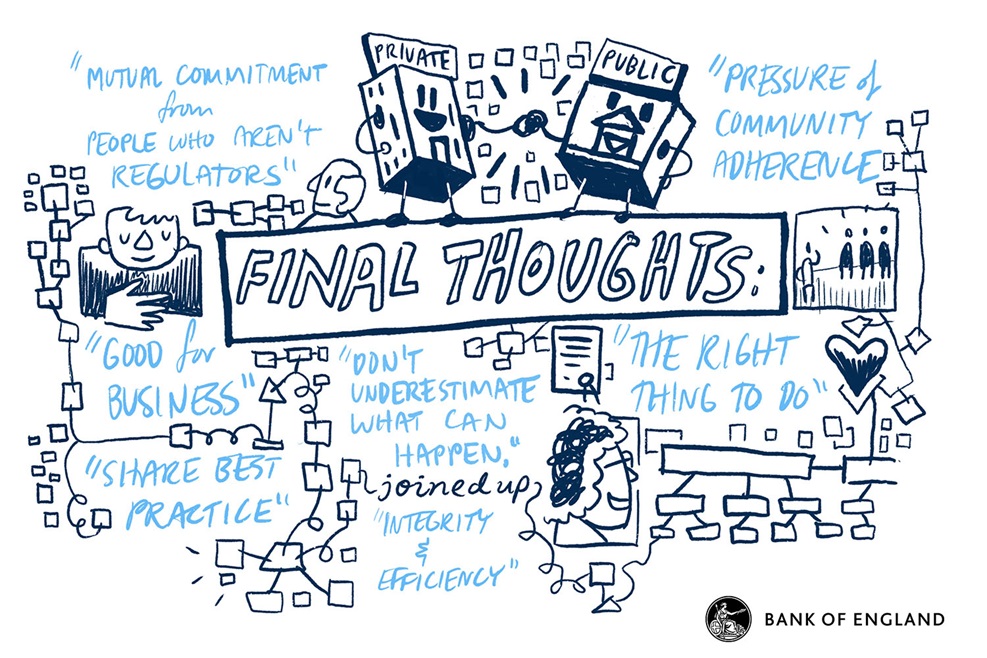

Speakers and panel discussions focused on issues of importance to FICC (fixed income, currencies and commodities) markets, such as the transition off Libor to near risk-free rates, the evolution of sovereign bond markets, technology, and the role of voluntary codes in raising industry standards. The key themes to emerge from the conference were the commitment of market participants and official sector to ensure a smooth transition off Libor; concerns about market liquidity due to relatively untested market trading infrastructures; and preparing for forthcoming technological change.

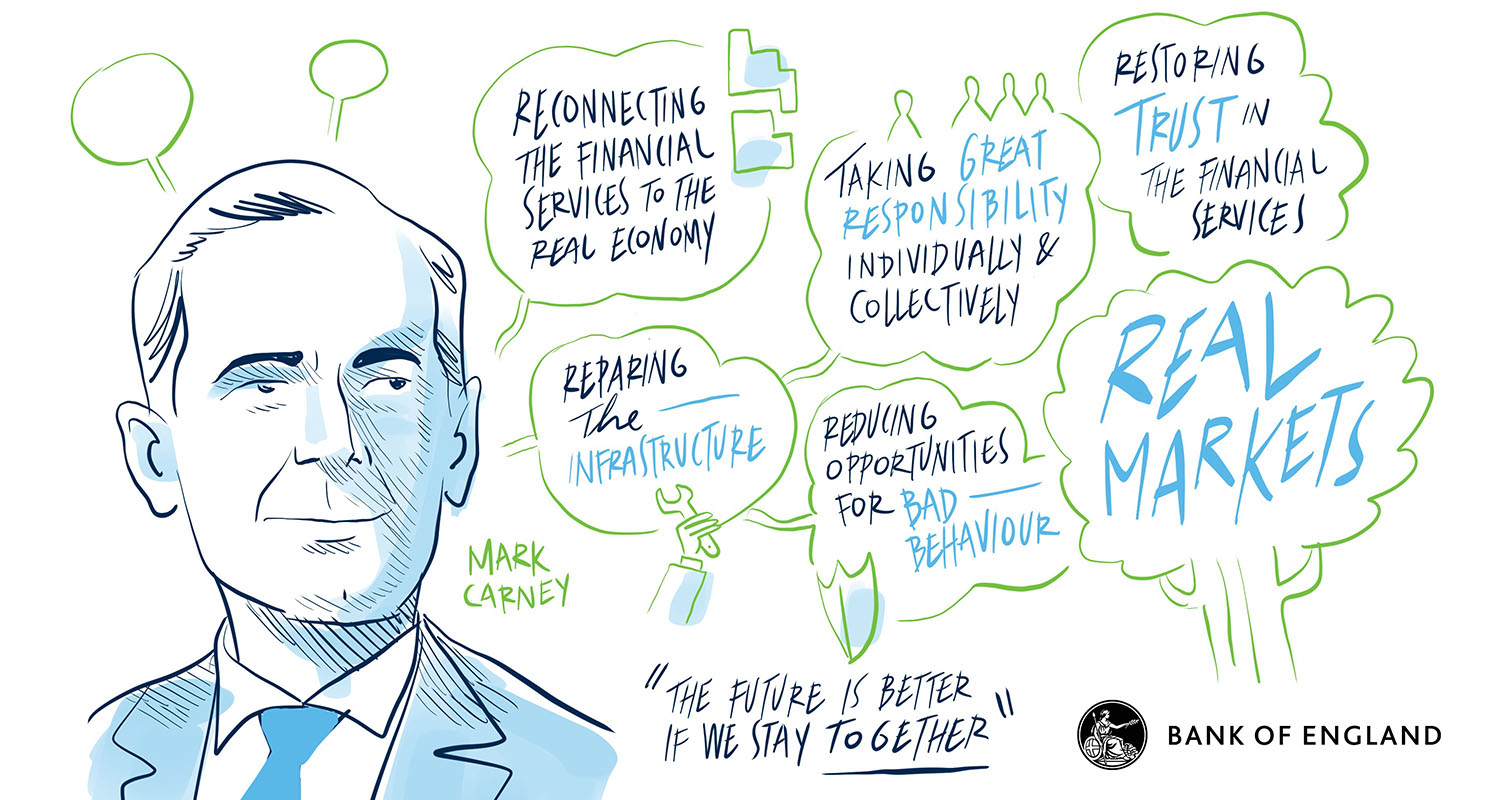

Mark Carney, Governor of The Bank of England, introduced the event and keynote speakers included:

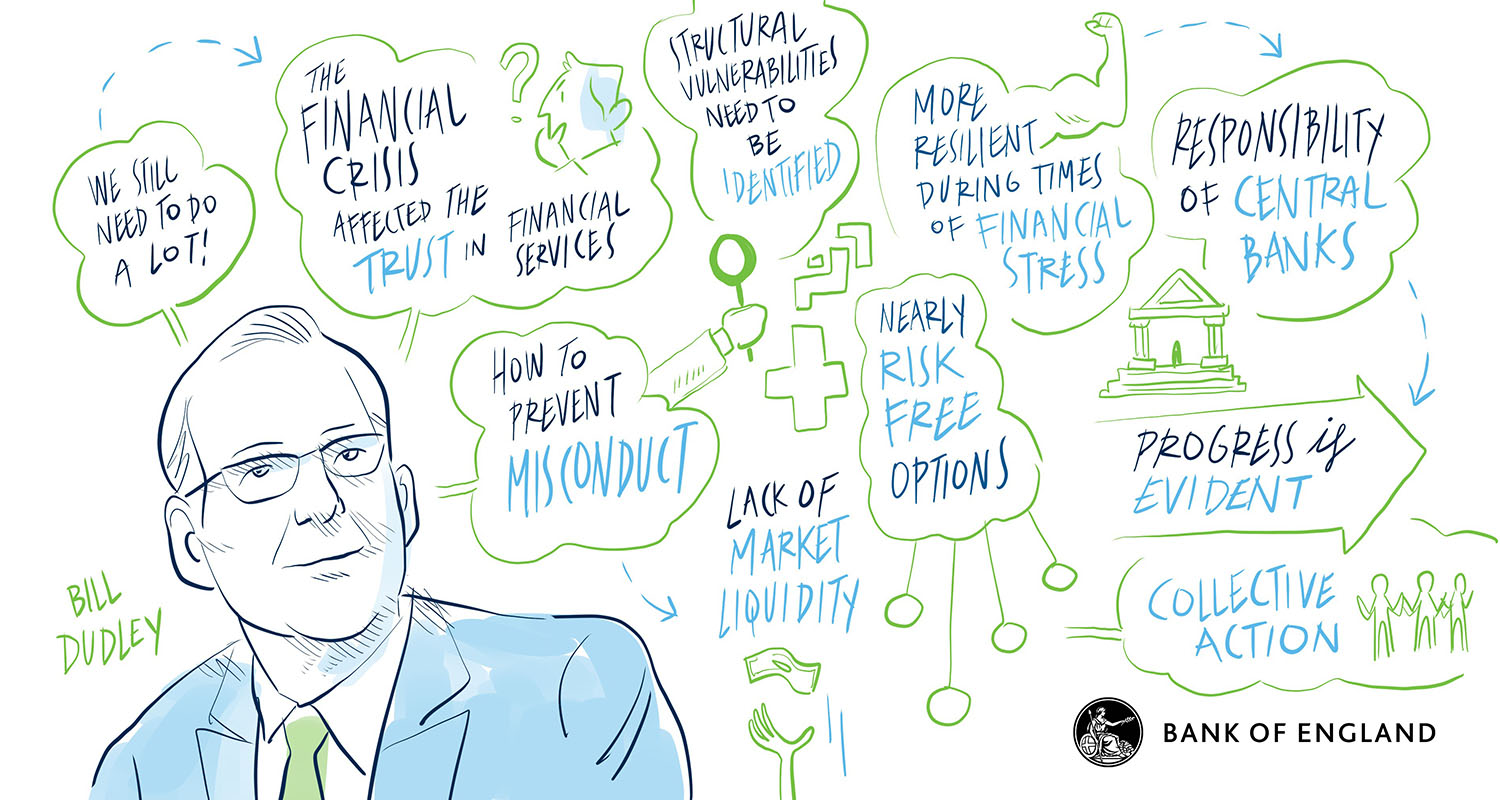

- Bill Dudley, President of the Federal Reserve Bank of New York

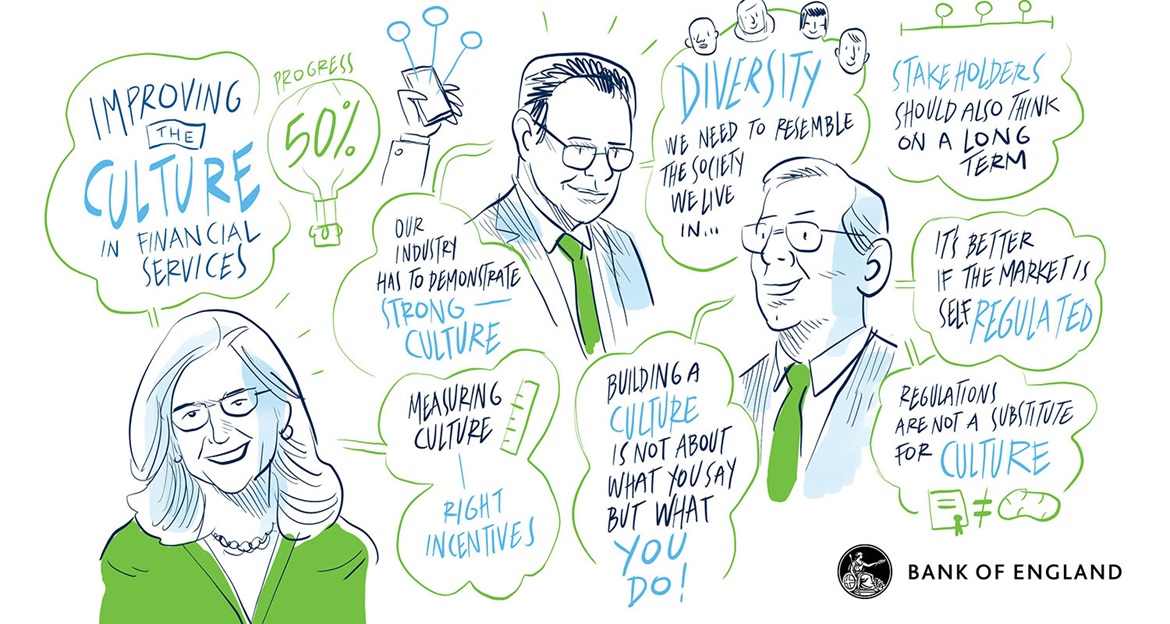

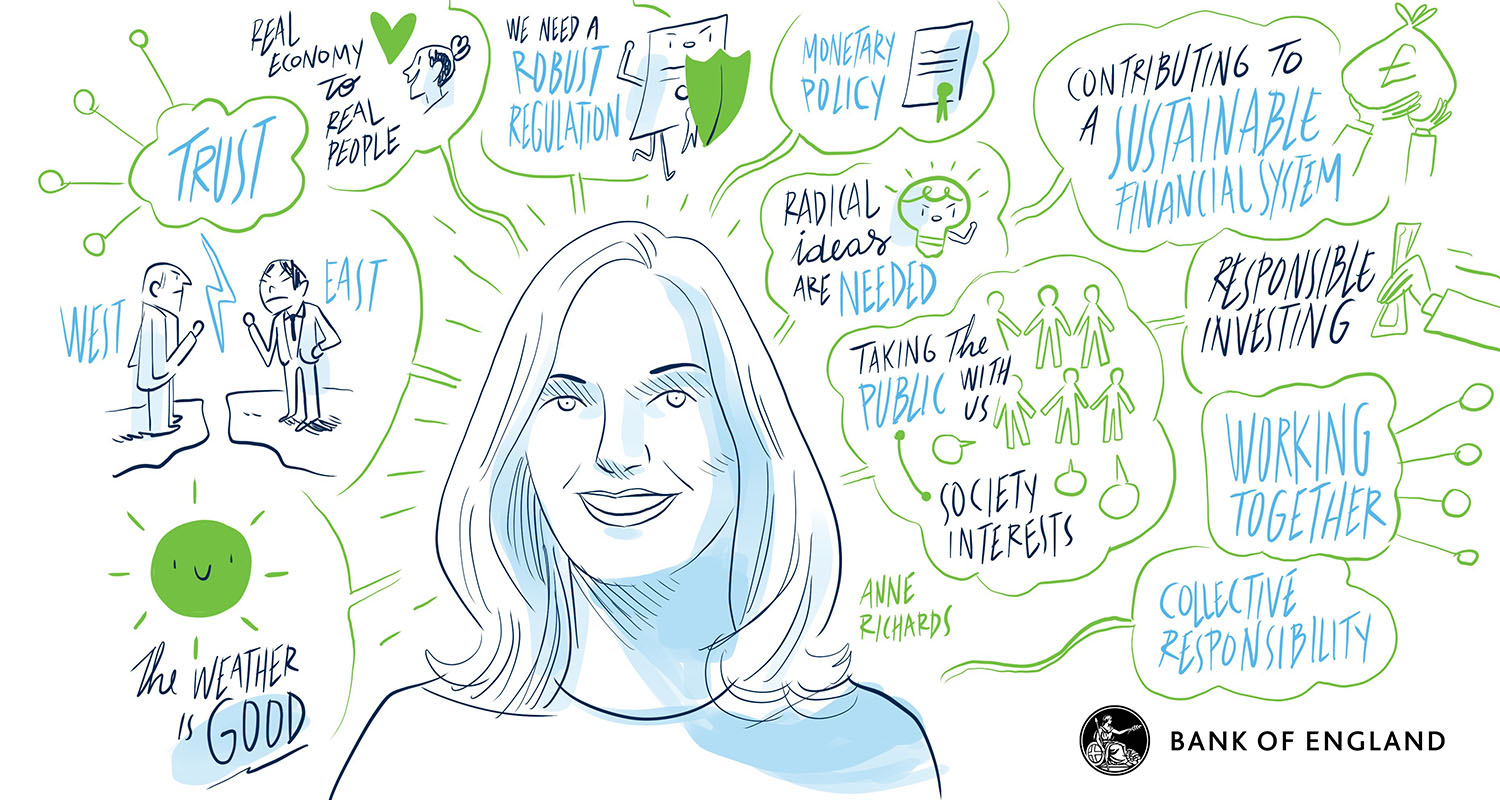

- Anne Richards, Chief Executive Officer of M&G Investments

- Charles Roxburgh, Second Permanent Secretary at the Treasury.

For more information about this event, please contact stakeholderrelations@bankofengland.co.uk