Blog

Eleanor Paton, Collections Manager

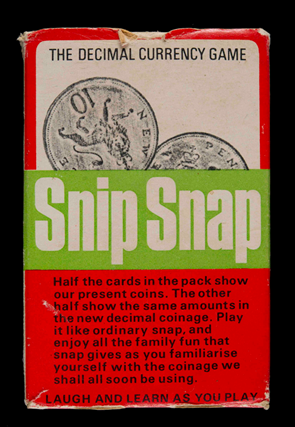

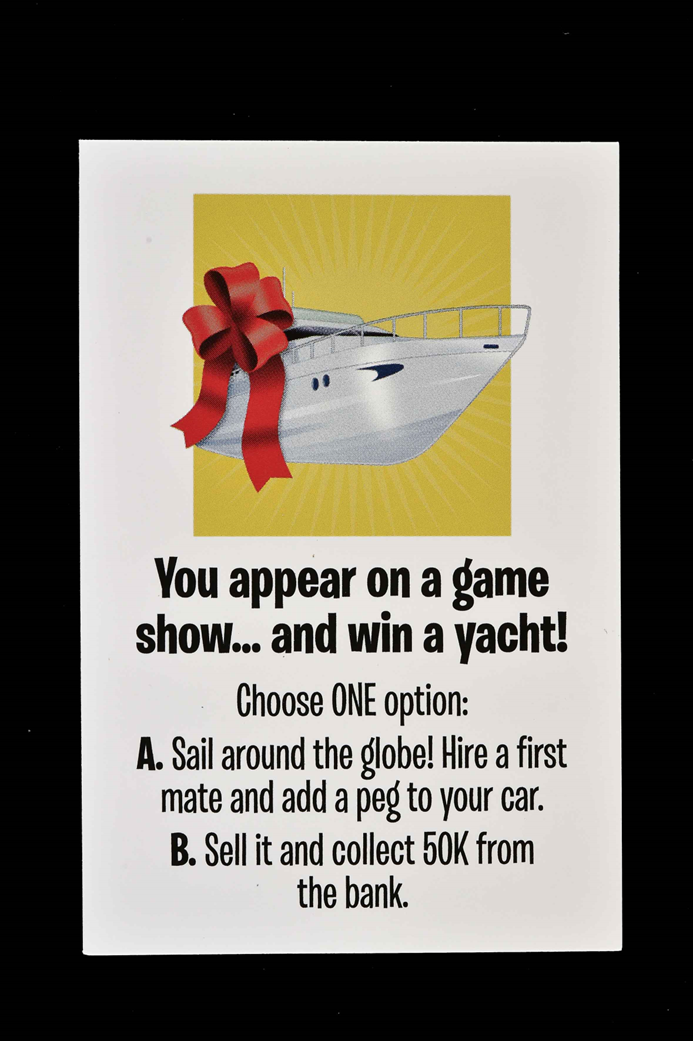

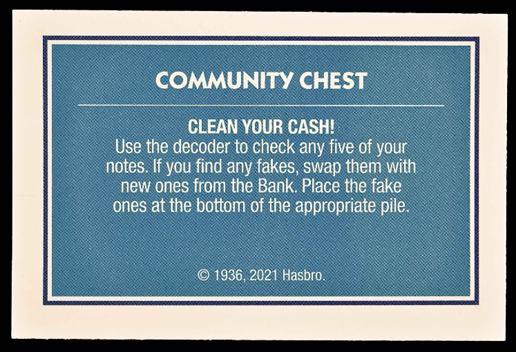

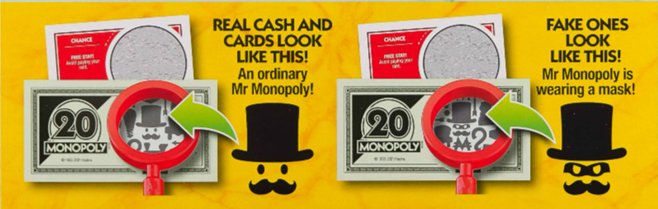

When you think back to the games you played as a child, you might not think about the life skills they taught you. And yet, play is one of the most important ways kids (and adults!) learn. Whilst financial literacy concepts may not be thrilling, many card and board games we grew up with teach us these skills subtly.

Games from the past also give us a glimpse of societal norms at that time, such as what money looked like, ideals for saving, or typical life milestones. Let’s look at the different lessons the games in our collection teach us.